Apple's latest product launch marked what many are calling its "boldest design move" in recent years, introducing devices including the ultra-thin iPhone Air.

Apple's latest product launch marked what many are calling its "boldest design move" in recent years, introducing devices like the ultra-thin iPhone Air and AI-driven AirPod features. However, questions remain about its potential to create a ripple effect in China, the world's largest consumer electronics and smartphone market.

Apple Chief Executive Tim Cook at the company's launch event this week praised new models as the "biggest leap ever for the iPhone." The new lineup includes the iPhone Air; the iPhone 17 Pro series with an upgraded screen and camera, and a 2TB storage option; and AI-powered AirPods.

In China, orders for the new iPhones began on Friday, with sales set to start on September 19. Yet, the Chinese market is a unique and challenging landscape, with local competitors rapidly advancing their own deeply integrated AI functionalities.

According to IDC analyst Guo Tianxiang, Chinese consumers have shown strong interest in the new major design and hardware overhaul in iPhones, but the iPhone Air's ultra-slim design will likely attract "only a thin slice of early adopters." More importantly, Apple's lag in on-device AI features is becoming a significant challenge in China as local rivals race ahead with deeply integrated, China-specific intelligence.

Apple's diminishing market buzz is also telling. Once dominating online consumer attention in China, the company's much-hyped annual launch of new products now shares the limelight with similar events staged by domestic rivals Huawei and Xiaomi.

Despite its high-end positioning, Apple faces stiff competition from domestic brands. In the second quarter, Huawei reclaimed the top position in the Chinese smartphone market with a market share of 18.1 percent, followed by Vivo, OPPO, Xiaomi and Apple, according to IDC.

This is compounded by complex geopolitical factors, including Apple's manufacturing shift to India because of US tariffs, which inevitably could impact consumer sentiment. Furthermore, compliance with Chinese regulations has led to the absence or delay of certain features, including some related to artificial intelligence.

Popular tech blogger Mio said he is considering purchasing an iPhone 17 in Hong Kong or Singapore to access all the features.

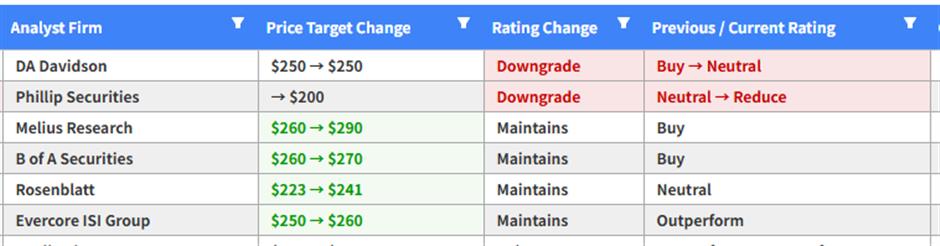

A charter of investment banks downgrading Apple's share ratings, according to a report of Chinastarmarket.cn.

After the launch, investment banks and analysts have downgraded Apple's share ratings to Neutral and even Reduce.

Apple must address several critical issues to succeed in the Chinese market. Some of these issues, however, appear to have a long road ahead.

The pricing conundrum

Apple has lowered the entry price of a specific 256 gigabyte iPhone 17 model to 5,999 yuan (US$843), making it eligible for a Chinese government subsidy under a program that encourages consumers to trade in old electronic devices for new ones. However, the subsidy applies only to a single entry-level model, while leading devices from Huawei and Vivo are subsidized in a much wider range.

IPhone Air's balancing act

The pursuit of an extremely thin and light design for the iPhone Air comes at the expense of battery life and photography capabilities. This is an obvious drawback in China, a market where social media and short video apps drive high demand for robust camera performance and all-day battery life. Portable power banks are a necessity for many users, and the new phone will likely require multiple charges per day, negating its key advantage of being thin and light. Apple's MagSafe battery pack, an accessory, only further undercuts the phone's primary selling point.

Limits of eSIM

The Chinese version of the iPhone Air supports eSIM, or embedded subscriber identity module, technology without physical SIM card slots. However, only China Unicom currently offers this service, and users must register in person at a store due to local regulations. This lack of convenience, combined with the phone's compromised battery and camera, makes it a tough sell for mainstream consumers.

However, China Mobile, the world's largest mobile operator, announced its readiness to activate eSIM services just two days after the iPhone Air's launch.

A screentshot of Apple China's website, saying that Apple's AI service is still waiting for regulatory approval.

The AI gap

As one technology media outlet put it, "Without discussing AI, the new iPhone might be the best phone in the world." Well-known investor Zhu Xiaohu said at an event in Shanghai recently that Apple's AI abilities in China are "completely unremarkable."

During the product launch, Apple officials repeatedly emphasized the phone's durability. This focus evokes a sense of déjà vu, recalling Nokia's similar marketing tactic for its unbreakable phones before their eventual decline. It raises the question of whether a focus on hardware durability is enough.

Despite these challenges, Apple retains a strong brand name and a loyal base of fans.

Li Jun, a tech enthusiast, said he is planning to buy the iPhone 17 Pro Max for its new orange color and enhanced 48-megapixel triple-lens system with 8x optical zoom.

"Apple's ecosystem is so smooth, much better than what domestic brands offer," he told China Biz Buzz.