Asian investors are tending to dismiss every twist and turn in US President Donald Trump's erratic tariff policies, focusing on issues closer to home and leading stock markets to weekly gains. Foreign funds seeking a safe haven are flowing into Asia.

South Korea's Kospi, for example, jumped 4.3 percent in the past five trading days despite a letter from Trump warning of a 25 percent tariff if a trade deal isn't cut with the US by an August 1 deadline. Japan's Nikkei rose on Tuesday after Tokyo received a similar letter, though the index was down 0.4 percent on the week.

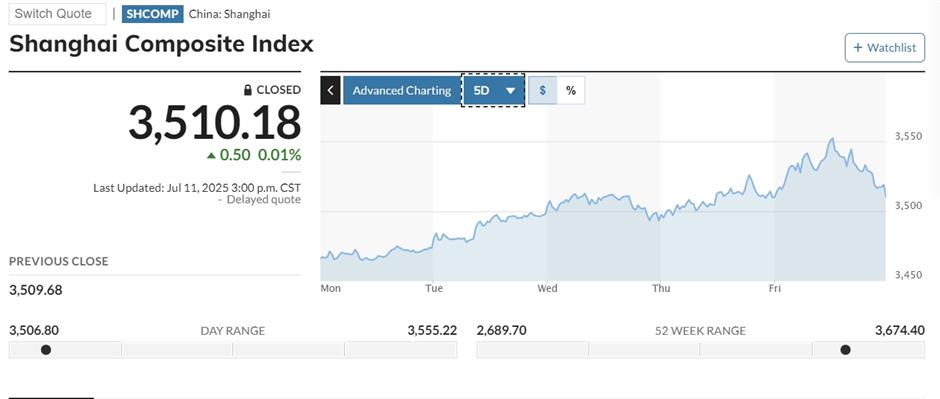

The Shanghai Composite Index in China surged 1.2 percent in the week, even as Chinese officials continued to criticize US tariff policy and accuse Trump of bully tactics with trading partners. The index ended at 3,510.8, the first time above the key technical level of 3,500 in three and a half years, on strength in financial shares, especially in the brokerage sector.

"With Trump seemingly a bit impatient, investors are getting back on regular tracks and ignoring the unpredictable," said Huang Wentao, an economist at Citic Securities.

The Shanghai Composite Index returned the key technical level of 3,500 in three and a half years this week.

US and European investors showed less nerve amid Trump's policy shifts. The Stoxx Europe 600 index lost some of the week's gains, falling 1.1 percent on Friday as the EU awaited a tariff warning letter promised by Trump. In New York, the Dow Jones Average of 30 stocks ended the week with a 1 percent decline, the S&P 500 lost 0.3 percent, and the Nasdaq slipped 0.1 percent.

Raymond Cheng, chief investment officer of North Asia for Standard Chartered, advised investors to focus on certainties.

"The tariff war has led to a weak US dollar and diverted more funds into emerging markets," Cheng said. "Asian markets are sure to offer more opportunities, and we suggest investors diversify not only assets categories, but also geographic locations."

Cheng said he expects the US dollar to remain soft. In the first half of this year, the greenback plunged 11 percent against major currencies, its worst six-month performance in 50 years.

The Hong Kong market is a good investment destination, he said, as the city forges closer ties with Chinese mainland markets and welcomes share sales from technology companies. The city topped the world in initial public offerings in the first half, with 42 new listings raising HK$106.7 billion (US$13.5 billion).

This week, five Chinese mainland companies, including chip designer Fortior Technology, Apple supplier Lens Technology and robot maker Geekplus, raised a combined HK$10.4 billion from initial share sales in Hong Kong and ended their trading debuts at a premium to their offer prices. The Hang Seng index increased 1.3 percent during the period.

Cheng said good investment bets in the second half include shares of technology companies, telecoms and suppliers of consumer goods dependent on disposable income spending. Still, consumer stocks such as Pop Mart and Laopu Gold, which have experienced steep rises in value, were down in the week.