A participant tests a wearable diagnostic device at a medical technology fair in China. While most exports to the EU are still in the mid-to-low end range, Chinese firms are pushing innovation across multiple segments.

When a hospital in China opened bidding on a new MRI machine last week, everything looked routine. The project had funding of 86.7 million yuan (US$12 million) – tick. The specs included foreign manufactured equipment – tick. But one line in the procurement document was different: Devices made in the EU were excluded.

The procurement by the First Affiliated Hospital of Xinxiang Medical University in Henan Province was the first evidence of a new Chinese ban on certain medical devices from the European bloc, a tit-for-tat retaliation after the EU curbed Chinese companies from bidding on tenders for some medical technology products.

It was a clear sign that some trade tensions with Europe are now moving to hospital floors. But beyond that, there's a larger message for foreign medtech companies: If you don't build here, you won't sell here.

The EU curb covers tenders for medical equipment valued at 5 million euros (US$5.8 million) or more, and it further stipulates that any non-Chinese company winning a contract can't supply equipment using more than 50 percent of components from China.

The China sanctions relate to any government procurement of medical devices valued at 45 million yuan or more. The one exemption is medical equipment made by EU companies in China.

That exclusion was music to the ears of Siemens Heathineers, a German medtech company that operates units in Shanghai and Shenzhen, and the Dutch-owned Philips facility in Suzhou, which both remain eligible to bid.

Some Chinese medical-device exporters, like Mindray, report that their EU projects are typically well below the 5-million-euro threshold and thus unaffected by the new restrictions. Therein lies the rub. As Beijing sees it, trade in medical devices with the EU is asymmetrical.

China exported over US$9 billion in medical devices to the EU last year, most of it in the mid to low-end range, like disposables, diagnostic reagents and home-use monitors. Whereas EU exports in medical devices to China were concentrated in high-end capital equipment like MRIs, CT scanners, linear accelerators and surgical robots.

China can source lower-end devices elsewhere or ramp up domestic production. But for hospitals needing cutting-edge imaging or radiotherapy systems, the list of suppliers narrows fast. European firms like Siemens, Philips and Elekta have long dominated that space.

So when China draws a red line around EU-origin products, it's the EU that faces a sharper loss – not just in sales but also to its position in the world's second-largest health-care market, which is expected to reach exceed 2.2 trillion yuan by 2030.

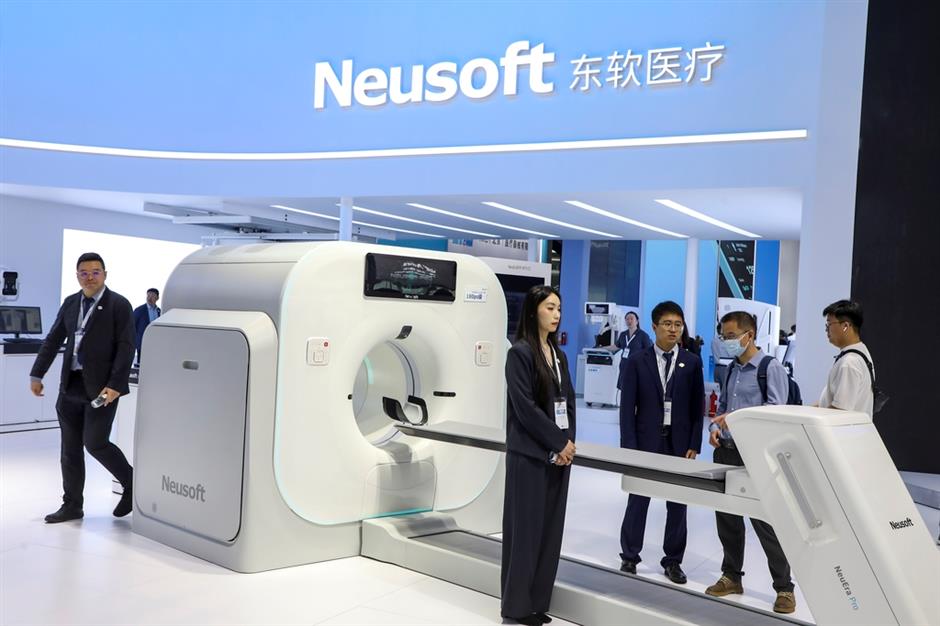

Visitors examine a Neusoft Medical high-end imaging system on display at a medical equipment expo in China. As EU-origin products face procurement restrictions, domestic brands like Neusoft are gaining visibility in hospital tenders.

At the same time, domestic firms stand to gain from any vacuum created. Hospitals and other medical facilities still need MRIs, advanced CTs and robotic systems. Increasingly, they will turn to Chinese suppliers to fill gaps. For Chinese medtech firms, this may be the most consequential window of opportunity in years.

Companies like United Imaging, Neusoft Medical and Mindray have long played second fiddle to European brands in high-end imaging and treatment systems. But years of quiet catch-up, driven by state support, have increased research, development and product quality.

United Imaging, for instance, has developed its own 3.0T MRI and PET/CT lines that are already in use at leading provincial hospitals. Neusoft is pushing into high-slice CT and photon-counting CT development segments. Mindray, traditionally strong in monitoring and anesthesia, is extending its footprint into integrated surgical and intensive care solutions for large public hospitals.

With EU-origin rivals disqualified from major bidding for now, procurement officials are increasingly evaluating the domestic market, not as a fallback option but rather as a serious place to source needed equipment.

It helps that the central government is widening the path for domestic players. Recent procurement guidance explicitly favors "localized innovation." Several provincial health systems have quietly updated their bid criteria to prioritize China-made or China-assembled systems.

For a long time, the question was: Can domestic brands deliver on performance? Now the question becomes: Can they deliver at scale and fast enough?

"Localization" used to be a common buzzword in boardrooms. Now it's a do-or-die line on the balance sheet.

Some companies saw this coming and moved early.

Siemens Healthineers built full diagnostic and lab centers in Shanghai and Shenzhen aimed at launching 20 "made-in-China" products this year. Philips operates a research, development and manufacturing hub in the Suzhou Industrial Park.

The writing is on the wall even for companies outside the EU. Swiss-based Roche Diagnostics and US-based GE HealthCare are taking steps to localize their products.

Roche Diagnostics expanded its facility in Suzhou to manufacture Cobas systems and other diagnostic products for the Chinese market, while GE HealthCare's Wuxi site, its largest global hub for imaging and patient-care equipment, produces CT, MRI and monitoring systems with increasing ratios of local components.

Still, many suppliers – particularly in high-value segments like linear accelerators, radiotherapy platforms and surgical robots – still rely heavily on EU production. Companies like Elekta and smaller European manufacturers now face a choice: localize fast or lose ground.

The push for localization isn't just about sales; it's also about trust, adaptability and long-term commitment. As health-care systems evolve and geopolitical tensions persist, companies that can operate with both global standards and local roots may find themselves best positioned.