China's stock market rose this week, led by AI-related stocks caught up in a global frenzy triggered by unexpected news from US technology giant Oracle that sent its shares surging 36 percent in one day to a new record. Investors in China were also assured by newly released economic figures.

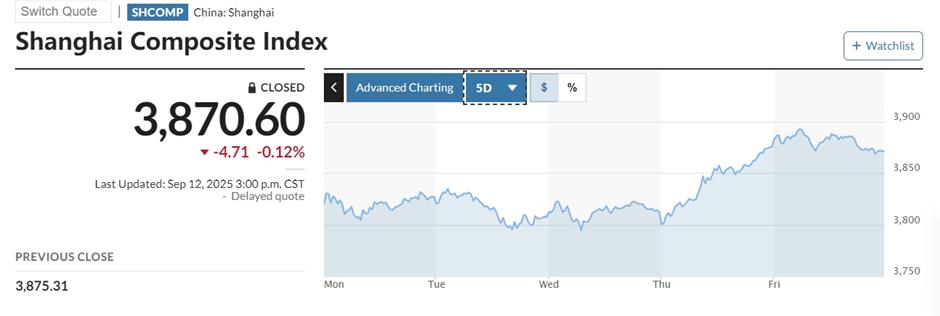

The benchmark Shanghai Composite Index gained 1.52 percent during the week, ending at 3,870.60 points on Friday. The Shenzhen Component Index jumped 2.31 percent, while the Growth Enterprise Index, which focuses on tech startups, was up 1.89 percent in the past five trading days.

"Investors shook off fears of an overheated market and remained optimistic about China's economic outlook," said Lin Chengwei, an analyst with Zheshang Securities.

The benchmark Shanghai Composite Index, despite of a 0.12-percent cut on Friday, still gained 1.52 percent during the week.

On Monday, China released trade data showing August exports grew 4.4 percent from a year earlier despite of a 33-percent plunge in shipments to the US. In contrast to countries like France, the US and UK, which face problems related to government debt, budgets and political discord, China appeared a global safe haven.

Artificial intelligence stood front and center at the 2025 Inclusion Conference on the Bund in Shanghai, a global event highlighting the latest breakthroughs in technology, keeping AI at the forefront of investment.

"It is no longer a wish but mandatory for companies to integrate AI into their operations," Yu Bin, vice president of Alibaba's Ant Digital Technologies, told the conference.

Alibaba announcements dominated the Chinese tech realm this week. The company said it plans to raise US$3.2 billion through the sale of zero-coupon, convertible bonds to fund international expansion and expand data centers used in cloud computing. Its Ant arm rolled out its first humanoid robot at the Shanghai conference, and Alibaba also announced it is open-sourcing its latest AI model, built on the new Qwen3-Next architecture, which is 10 times more powerful but cheaper to build than its predecessor.

In other announcements, Alibaba's navigation arm launched Amap Street Stars, an AI-powered ranking system rating local restaurants, hotels and tourist attractions, Alibaba-backed Hello, a bike-sharing and ride-hailing company, debuted its first driverless taxi, and Alibaba logistics arm Cainiao said it will expand its global five-day delivery service to Vietnam, Singapore, the Philippines, Hungary, Austria and Qatar. Alibaba shares in Hong Kong surged 13.6 percent this week.

But it was Oracle that captured the biggest global headlines this week. The company on Wednesday announced it has signed four multibillion-dollar AI contracts and predicted its cloud business will grow 77 percent to US$18 billion in its current fiscal year. That fired up AI-related stocks across global markets. The skyrocketing market cap of the company catapulted Oracle co-founder Larry Ellison to briefly overtake Tesla's Elon Musk as the world's richest man. However, profit-taking set in on Friday, paring 5.1 percent from Oracle's share price.

Apart from China's mainland, Hong Kong's Hang Seng Index advanced 3.73 percent this week, and Japan's Nikkei rose 3.03 percent. South Korea's Kospi surged 5.79 percent after SK Hynix shares surged 5.8 percent to a 25-year high following the company's announcement that it is ready to mass produce its next-generation high-bandwidth AI chips ahead of rivals.

In New York, the tech-heavy Nasdaq hit a record close on Friday, rising 2 percent for the week. The broader S&P 500 gained 1.6 percent, its best weekly performance since early August, and the Dow Jones Average climbed 1 percent. Investors are betting that the Federal Reserve Bank will cut rates when it meets next week.