Chinese investors brushed off lower-than-expected economic data for July and took heart from an extension in the China-US trade truce, some positive company earnings, US-Russian talks on ending the Ukraine war and global anticipation of cuts in US interest rates.

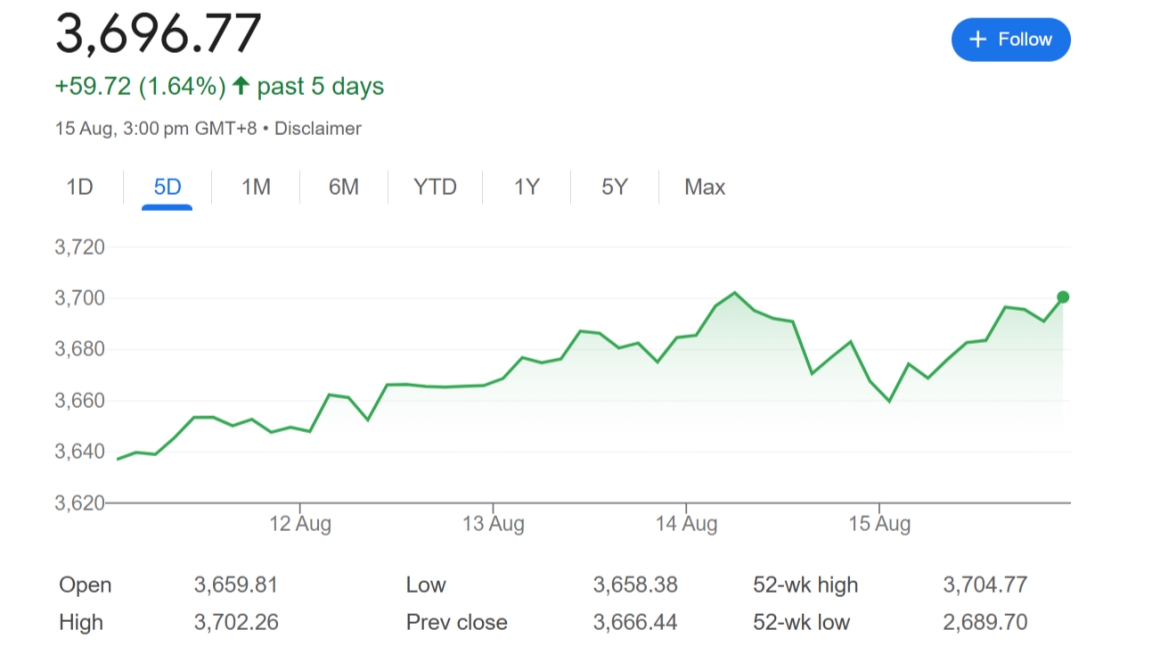

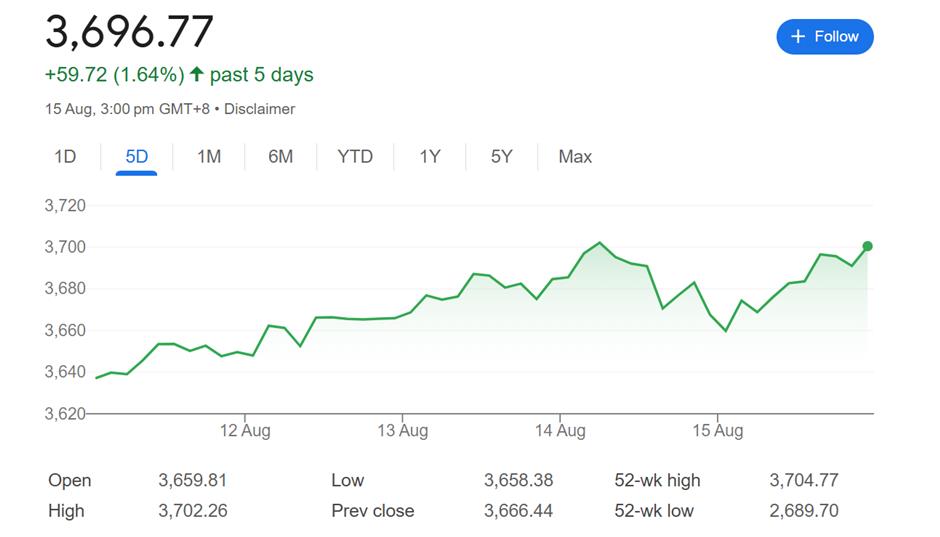

The Shanghai Composite Index rose 1.7 percent in the past five trading days, ending the week at 3,696.77. It briefly breached the 3,700 point level on Thursday.

"The Trump-Putin summit offers a new chance for change, and that also changes investor sentiment as well as market performance this week," said Zhang Yiping, an analyst with China Merchants Securities.

However, a three-hour meeting between US President Donald Trump and Russian President Vladimir Putin in Alaska that ended after global markets closed produced no Ukraine ceasefire deal, with both leaders saying only that peace is a work in progress. No details of the talks were announced.

On a brighter diplomatic front, the US and China announced that a 90-day truce in their tariff war has been extended for another three months as talks on a trade deal continue.

"Meanwhile, China's economic performance for July was stable but remained cautious and could exert pressure on stock trading in the coming week."

The National Bureau of Statistics released data on Friday showing slowing growth in industrial production, fixed-asset investment and retail sales. New home prices across China fell in July, a sign that the long downturn in the property market isn't over yet.

The Shenzhen Component Index gained 4.55 percent for the week while the Growth Enterprise Index surged 8.56 percent, with some startups, such as Insta360 posting gains on breakthrough product developments.

Japan's Nikkei surged 5.07 percent for the week, while South Korea's Kopsi gained 0.16 percent.

Among Chinese companies reporting earnings this week, the Hong Kong-listed shares of Internet and game giant NetEase fell 3.7 percent despite higher earnings and revenue but sales missing analysts' forecasts. E-commerce heavyweight JD.com reported a 51 percent plunge in second quarter profit as its instant-food delivery service ate into revenue. Its Hong Kong shares tumbled 3.4 percent. Shares in popular microblogging platform Weibo surged 10 percent, however, on stellar earnings.

Forbes reported that Bridgewater Associates, the world's largest hedge fund, adjusted its portfolio in the second quarter, exiting investments in Chinese companies like Alibaba, Baidu and Nio. In another strategy shift, Singapore sovereign wealth fund Temasek Holding turned its investment focus in China to consumer businesses from technology companies, slashing holdings in Alibaba and JD.com, and increasing its stakes in PDD Holdings and Yum China. The value of Temasek's portfolio of Chinese stocks listed in the US, however, decreased by over one-third in the second quarter

In New York, the major averages closed flat to lower on Friday but posted gains for the week on hopes that tame July inflation data would push the Federal Reserve to cut interest rates. The Dow ended the week up 1.7 percent, the broader S&P 500 gained almost 1 percent and Nasdaq added 0.8 percent.