With the global tariff war drawing closer to a less disruptive conclusion than expected and technology shares shining, Asian stocks rose this week. Chinese investors were heartened by news that China-US trade talks are scheduled to resume on Sunday in Stockholm, after US trade deals with Japan, the Philippines and Indonesia were finalized ahead of an August 1 deadline.

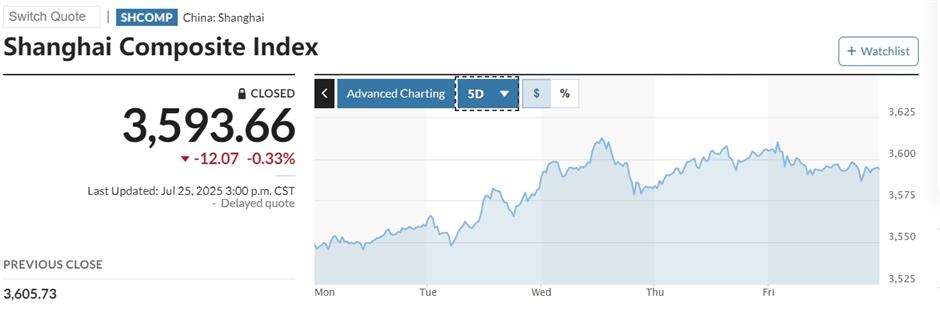

China's benchmark Shanghai Composite Index gained 1.7 percent in the past five trading days, after it broke through the key technical level of 3,600 for the first time in three-and-a-half years on Thursday, with nearly 4,400 stocks posting gains.

The smaller bourse in Shenzhen posted a sharp rise of 2.3 percent for the week, while Hong Kong's Hang Seng Index advanced 1.6 percent.

China's benchmark Shanghai Composite Index broke through the key technical level of 3,600 for the first time in three-and-a-half years on Thursday,

"Sentiment has undergone a subtle change," said Huang Wentao, an economist at Citic Securities. "We are holding our breath to see the results between China and the US after Japan reached a trade deal."

Japan's Nikkei jumped 3.45 percent for the week, after US President Donald Trump announced that it will impose 15 percent tariffs on Japan's exports to the US, including cars. In exchange for lower tariffs than threatened, Japan agreed to invest US$550 billion in the US and to open its market to imports of US vehicles and rice.

In South Korea, which has yet to sign a deal with the US, the Kospi index gained 0.2 percent. SK Hynix shares were buoyed by strong second-quarter earnings.

Technology shares, which the securities regulator reported now account for more than 90 percent of newly listed companies on the STAR Market, ChiNext and Beijing Stock Exchange, have been the main driver of the bull market in China. The value of Class A shares reached 105.5 trillion yuan (US14.7 trillion) by July 18, reflecting economic strength and depth of capital market reforms in China, according to the Shanghai Statistics Bureau.

Elsewhere in the world, European bourses closed mixed on Friday, after Trump laid the odds at achieving a trade deal with the EU by August 1 at 50-50. The Stoxx Europe 600 index was down 0.3 percent.

In the US, all three major averages posted weekly gains, with the tech-heavy Nasdaq and the broader S&P 500 index closing at new records. The Nasdaq was up 1 percent for the week, the S&P 500 rose 15 percent and the Dow added 1.3 percent.