China stocks slipped this week in tandem with a wave of equity market losses around the world as investors reacted to US President Donald Trump's latest blueprint for rewriting global trade. He unveiled tariffs on dozens of countries, imposing a 25 percent rate on India, a 35 percent rate on Canada and a 39 percent rate on Switzerland. He also announced new tariffs on transshipments to the US and the import of copper products.

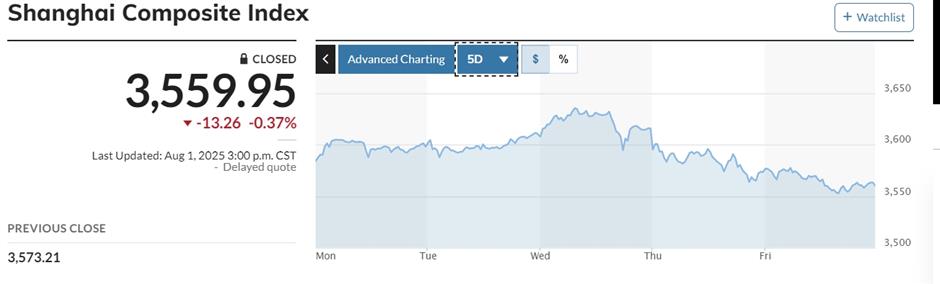

The benchmark Shanghai Composite Index retreated 0.95 percent, while the Shenzhen Component Index lost 1.7 percent and the Growth Enterprise Index dropped about 1 percent. Hong Kong's Hang Seng plunged 3.7 percent, partly on new supervisory rules related to the city's new stablecoin initiative.

Elsewhere in Asia, Japan's Nikkei 225 lost 1.7 percent, and South Korea's Kospi dived 3.4 percent.

"Corrections are expected in a world affected by US tariff policies," said Gu Fengda, chief analyst with Guosen Securities. "Investor sentiment is changing fast as countries seek the best trade deal with the US, but nobody seems to get one."

In Europe, the broad Stoxx Europe 600 index retreated 1.9 percent on Friday. In New York, where investors were also rattled by data showing a weaker US economy, major averages suffered their worst weekly performance since May 23, with the S&P 500 losing 2.4 percent and the Nasdaq down 2.2 percent.

The benchmark Shanghai Composite Index retreated 0.37 percent on Friday, wrapping up the week with a loss of 0.95 percent.

Attention this week was focused on US trade deals as Trump's August 1 deadline for their conclusion loomed. The US has completed deals with Japan, South Korea, EU, UK, Vietnam, Indonesia, Pakistan, Thailand and the Philippines – with all deals imposing tariffs ranging from 10 percent to 20 percent on exports to the US. Among major trading partners yet to sign deals are India, Brazil, Canada, Mexico, Australia and Switzerland. In almost all cases, tariffs in concluded deals are higher than the base rates imposed in April but lower than the tariffs Trump threatened during the negotiating process. Trade talks with China are continuing.

"There are still a lot of possibilities for China," Gu said. "Investors need to stay calm and be patient."

Turning from global trade anxieties, China this week focused on its domestic strengths. At a Politburo meeting this week, top leaders highlighted political stability, market size, production chains and professional talent.

"It's the first time China's leadership summarized economic advantages in such an overt and detailed manner," said Lian Ping, chief economist of the Guangkai Chief Industry Research Institute. "We believe China can mobilize its resources to focus on the domestic market and counter external uncertainties."

Looking at China, investors indeed found many bright spots. Fujian Province-based and Hong Kong-listed Contemporary Amperex Technology (CATL), the world's largest maker of electric-car batteries, reported net profit in the second quarter surged 34 percent from a year earlier to 16.5 billion yuan (US$2.3 billion), exceeding market estimates. Mainland instant food delivery platforms Meituan, Alibaba's Ele.me and JD.com announced a truce, of sorts, in their price war, China's gaming industry, the largest in the world, posted first-half sales growth of 14 percent, and retail sales of electric and hybrid cars in China in the first four weeks of July rose 15 percent from a year earlier.

The International Monetary Fund raised its forecast for China's economic growth this year to 4.8 percent this week, up of 0.8 percentage point from its April projection.

"It is not common for IMF to make such a substantial upward revision, reflecting the optimistic expectations of global business communities," Lian said.

In the first half, China's economy expanded 5.3 percent year on year, exceeding the 2025 annual target of 5 percent.