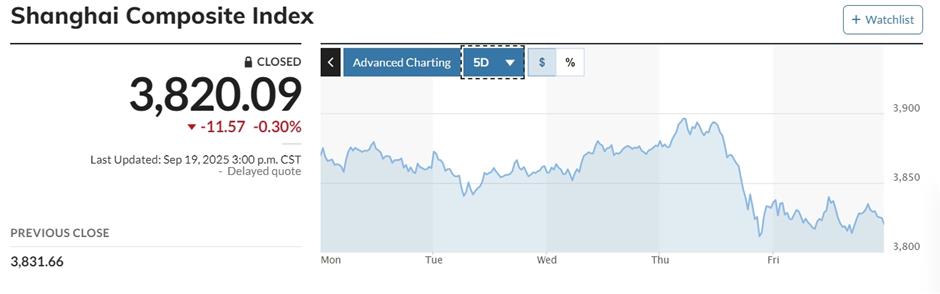

The Shanghai Composite Index, a leading benchmark of Chinese mainland stock markets, slipped from a rally to a slight loss on Friday, ending at 3,820, as a tug-of-war between bulls and bears dashed hopes of its topping 3,900 points.

The first US cut in interest rates this week buoyed early sentiment because of its generally positive effect on global markets.

"It was anticipated the US Federal Reserve cut in rates, although only a quarter of a percentage point, would be considered a piece of good news for China and other emerging markets," said Shi Lin, an analyst of Founder Securities. "The unexpected contraction by day's end indicated insufficient market confidence, with a wave of funds selling shares but another wave entering to stabilize overall performance."

The benchmark index in Shanghai edged down 0.3 percent on Friday after sliding 1.15 percent on Thursday. It concluded the week with a drop of 1.3 percent.

"Looking forward, the US cut will benefit the valuation of core assets of China-related stocks around the world as well as A-shares, and also allows more space for China's monetary policy," Shi said.

Smaller Chinese bourses reflected Shanghai's performance. The Shenzhen Component Index lost 0.04 percent on Friday after a slump of 1.06 percent on Thursday, while the ChiNext Index, which focuses on tech startups, was down 0.16 percent on Friday after falling 1.64 percent a day earlier.

The benchmark index in Shanghai edged down 0.3 percent on Friday after sliding 1.15 percent on Thursday. It concluded the week with a drop of 1.3 percent.

Margin trading, a key factor in this month's stock rallies, surged to a record 2.4 trillion yuan (US$338 billion) on Wednesday, with electronics, power equipment, non-bank finance and computer sectors among the stocks most favored by leveraged funds. Under margin trading, investors buy securities using funds borrowed from brokers.

The number of retail investors in Chinese mainland markets rose to 7.7 million by September 17, but US investment bank Goldman Sachs debunked the popular theory that millions of mom-and-pop investors are fueling market rallies, saying it's institutional investors providing most of the investment. Chinese equities have added about US$3 trillion in market value this year across Hong Kong and mainland markets, according to Goldman.

US financial service provider Charles Schwab, in partnership with the Shanghai Advanced Institute of Finance, said China's rising affluent population has shown increasing interest in mutual fund investments this year, with 43 percent of respondents in a survey saying they are in funds, the highest rate in five years. But the same survey showed that average maximum loss people are willing to tolerate has declined for three consecutive years, with 63 percent of respondents saying they can't tolerate investment losses exceeding 10 percent.

"Such investors are very active with a high engagement in investment, but at the same time, they sometimes have irrational investment behaviors," said Thomas Pixley, general manager at Charles Schwab in Shanghai.

The disconnect between return expectations and risk tolerance has led to increasingly impatient investment behavior. Over 70 percent of the respondents said they have held mutual funds for a period of less than one year, with 20 percent holding them for less than three months.

"For most investors, short-term strategies often result in sub-optimal outcomes and higher costs, and it is not good for a mature market," Pixley said.

Still, for institutional investors, this week's volatility didn't shake their confidence in the Chinese market.

Liu Jinjin, chief China equity strategist at Goldman Sachs, said the firm has maintained an overweight rating on both China A-shares on the Chinese mainland and China H-shares in Hong Kong, predicting further gains in the next 12 months. Goldman, for one, has raised its target price and "buy" rating on market darling tech giant Alibaba, which trades in Hong Kong.

Global institutional investors, including Citi, Jefferies & Co and CLSA expressed similar confidence in China's advanced technology companies, singling out Tencent, Baidu and BYD for their strong performance in the development of artificial intelligence.

"The Chinese market is expected to grow into a 'slow bull' market … It will be supported by the emerging industries while endure uncertainties brought by issues such as trade disputes," said Shi at Founder Securities.

In Friday trading, shares in automaker Xiaomi fell 0.3 after the company announced it is recalling a third of SU7 models to correct a flaw in the driver-assistance system. Shares in Neusoft surged 10 percent after the company said it has been said it has become the designated supplier of smart cockpit domain controllers for a "major" Chinese automaker.

For the week, Hong Kong's Hang Seng Index advanced 0.9 percent, Japan's Nikkei rose 0.54 percent and South Korea's Kospi gained 1.1 percent.

Rallies on Wall Street also continued. The S&P 500 gained 1.2 percent in the week, the Dow was up 1 percent and the Nasdaq rose 2.2 percent. In Europe, the Stoxx600 index slipped 0.2 percent.