Global investors were whipsawed by a barrage of news related to US tariffs, peace overtures in the Ukraine war, escalating conflict in Gaza and mixed corporate earnings results. Asian stocks were mostly immune, ending higher for the week.

"The world is a stage and there are too many dramatic shows are on this week," said Sun Lijian, an economics professor at Fudan University. "We are holding our breath to see the outcome of tariff talks, which will continue for many countries. China will do well for itself and keep economic foundations solid."

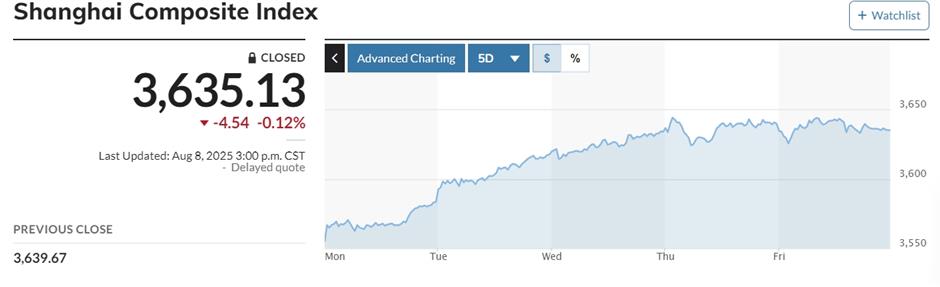

The benchmark Shanghai Composite Index jumped 2.1 percent for the week, hitting a new record for the year at one point, but it edged down 0.12 percent on Friday to end at 3,615.13. The Shenzhen Component Index rose 1.25 percent in the past five trading days, and the Growth Enterprise Index added 0.49 percent.

The benchmark Shanghai Composite Index hit a new record for the year at one point this week.

Although China-US trade talks continue without a breakthrough, Chinese investors were heartened by stronger-than-expected export figures for July, increased activity in the services sector and Standard & Poor's reaffirmation of its "A+" rating on China's sovereign credit. Investors appeared to shrug off US threats of higher tariffs on China if it continues to import Russian oil – a point that may become moot as a summit is scheduled between US President Donald Trump and Russian President Vladimir Putin next week.

Hong Kong's Hang Seng Index advanced 1.75 percent for the week though it fell almost 1 percent on Friday. The market was buoyed in the week by Tencent, which rose 1.6 percent ahead of a mobile game release, and by gains in online entertainment, banking and biotechnology shares.

Japan's Nikkei surged 1.85 percent on Friday, reflecting positive earnings from SoftBank and Sony, and expectations that the US will remove overlapping tariffs on imports of Japanese products. For the week, Nikkei gained 4.24 percent, and South Korea's Kospi rose 3.07 percent. India's Nifty and Sensex indexes dropped about 1 percent after the US doubled its tariff on India to 50 percent because of its refusal to end oil imports from Russia.

On the US tariff front, some corporate heavyweights have bowed to the pressure to concentrate their manufacturing facilities in America. Apple notably pledged an US$100 billion investment in US manufacturing over the next four year amid threats from President Donald Trump of higher tariffs on imports of phones made overseas.

The major US averages rose in the week, led by technology shares. The broad market S&P 500 rose 2.4 percent, just shy of a new record, and the Nasdaq climbed 4 percent to a record. Apple shares surged 13 percent this week. European shares were mostly flat to lower.