Shanghai-based Hozon Auto, which manufactures electric vehicles under the Neta brand, was hailed as a startup star in the industry just three years ago, outselling rivals like Nio and XPeng. Now it is under bankruptcy reorganization and hoping to find new investors to restart production.

The company reported losses of 18.3 billion yuan (US$2.6 billion) from 2021-23, according to a prospective for an initial public offering filed with the Hong Kong stock exchange in June 2024.

"The company's operations were halted in November 2024," Hozon said in a statement. "Despite the halt, its production line remains operational. We also retain over 400 employees, including its management team and core technical staff, indicating a readiness to resume manufacturing."

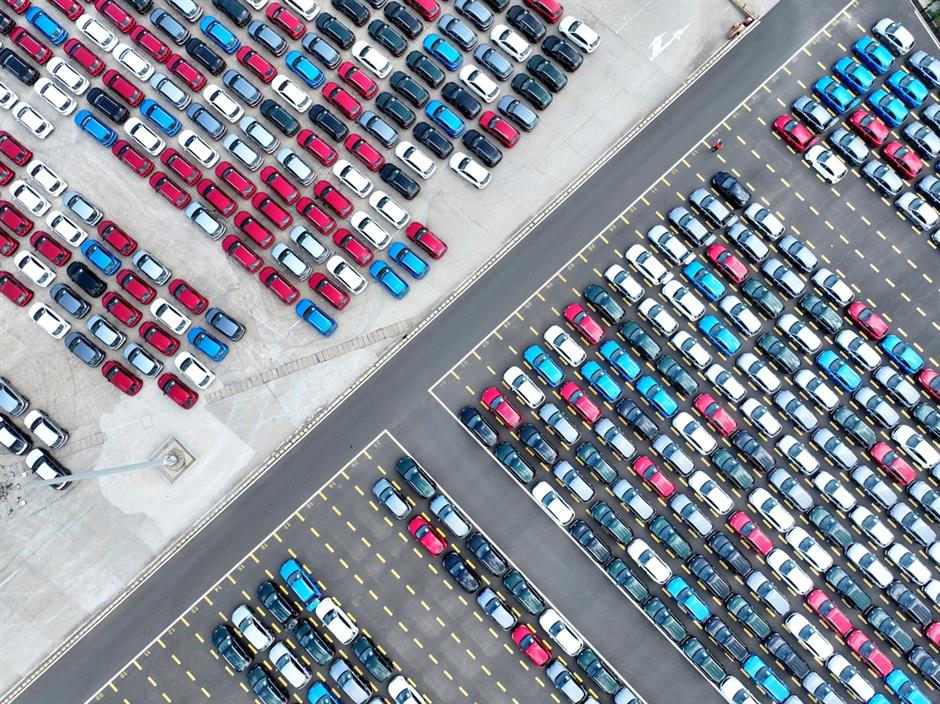

Hozon's once popular Neta model faces an uncertain future after huge losses over three years.

Hozon is not alone in finding itself a victim of brutal competition and price wars in China, the world's largest car market, where electric and hybrid vehicles account for 53 percent of all sales.

According to incomplete statistics, over 24 auto companies have either folded or undergone reorganization since 2022 – half of them in the electric and hybrid vehicle segment.

Consolidation and "casualties"

It's all part of a major restructuring of the industry.

One recent casualty is Ji Yue Auto, the joint venture brand of Baidu and Geely. It was reported to have entered into bankruptcy liquidation earlier this year, becoming the first 2025 electric-car brand to collapse.

Another notable casualty is Shanghai-based WM Motor, which filed for bankruptcy reorganization in October 2023. Once a peer to prominent electric-car startups like Nio and Xpeng, WM Motor suffered technological problems, a drastic reduction in research and development investment, and mounting legal disputes.

Where did these companies go wrong?

Ivan Chen, a senior researcher with a world-leading automotive technology supplier, told China Biz Buzz that high-risk automotive brands typically exhibit several common characteristics: over-reliance on low-price competition, hollowed-out technological capabilities, fragile cash flow and excessive dependence on a single market.

The Neta brand is a prime example.

"Neta Auto's excessive reliance on the business-to-business market ultimately backfired," Chen said. "Sales in that commercial segment accounted for a staggering 68 percent of Neta's total sales in 2023. However, after the ride-hailing market, one of its prime customers, became saturated last year, the company's shifted to consumer sales. That led to a drop in sales from 152,000 units in 2023 to a mere 64,500 units last year."

Even more critically, investment in research and development was only 4.7 percent of company revenue, far below the healthy industry standard of 10-15 percent. This technological vacuum became increasingly apparent, with its flagship Neta V model evoking a 33 percent complaint rate for in-car systems.

Simultaneously, the Neta brand found itself trapped in a self-destructive price war. After dropping the price of the Neta V to 59,900 yuan, the company incurred a loss of 82,000 yuan for every car sold, contributing to its accumulated losses over three years.

A market polarized

Chen said that the current new-energy vehicle market in China is polarized.

On one hand, there's an intensifying concentration of leading players. Giants like BYD and Geely dominate the market, commanding a combined over 42 percent market share due to their technological prowess, cost advantages and global reach.

Meanwhile, technology companies have been moving into the automotive sector, vying for a share of the market. Companies like Huawei and Xiaomi that started their corporate lives as phone makers and went on to branch out into new technologies, are leveraging their ecosystem strengths, initially capturing 6.9 percent of the electric car market. Xiaomi last month unveiled its second vehicle, the YU7 SUV, that undercuts Tesla on price and attracted pre-order sales of 289,000.

On the other hand, tail-end manufacturers are facing accelerating pressure to exit the market. Of 73 new electric car startups, 41 are struggling with monthly sales of less than a thousand units. Their survival space is being continuously squeezed.

After almost a decade of wild growth, the electric-vehicle market in China is entering a phase of consolidation.

"Adding to the mix, the government exemption of vehicle tax on electric and hybrid models will be slashed by half next year," Chen said. "That means manufacturers relying on the subsidies to sell cars have less than 18 months to adjust their strategies."

He added, "I believe over the next three years, the polarization in the electric vehicle industry's landscape will become even more pronounced. The Matthew principle – when the strong get stronger, the weak get weaker – will intensify."

Inevitable part of a maturing market

The ongoing consolidation in the industry is not necessarily a bad thing, but rather an inevitable path for the maturing electric car industry as it transitions from quantitative growth to qualitative transformation. In the "do or die" environment of the next three years, survival will hinge on possessing technological depth, operational precision and a global vision.

Technological breakthroughs will be the decisive battlefield where the industry landscape is determined.

Contemporary Amperex Technology (CATL), the world's biggest manufacturer of batteries for electric cars, has announced 2025 mass production of solid-state batteries with a charge range exceeding 1,000 kilometers. Xpeng's XNGP urban intelligent driving coverage has now reached 90 percent, boosting user payment rates from 8 percent to 25 percent.

"To survive this tech war, car companies must maintain annual research and development investment at over 15 percent of revenue, focusing on core technologies like battery safety and closed-loop algorithms, or they risk elimination," Chen said.

The era of unbridled growth was never going to be sustainable.

Human Horizons Group, parent of the HiPhi Auto brand, filed for bankruptcy last year, reporting a loss 8.2 billion yuan that resulted from blind expansion. Its two factories, with a combined annual capacity of 250,000 vehicles, were operating at a 6.8 percent utilization rate.

"Car companies must return to rational operations to firmly establish themselves in this capital-intensive struggle," Chen said.

Companies in stress are prime targets for mergers and acquisitions. Under reorganization, the HiPhi Auto brand has received investment from the Middle East. There's talk WM Motor might be taken over by another Chinese auto firm. Hozon Motor has denied rampant speculation that it will be bought out by Toyota.

What lessons have been learned by automakers will shape the future of the industry.