Price war in China's fast-food delivery market a boon for consumers, a bane for corporate bottom lines

For Chinese consumers keen on takeaway food, this is a summer of cheap eats. For delivery businesses like Alibaba, Meituan and JD.com, it's a season eating into revenue.

The so-called "takeaway war" in the fiercely competitive on-demand food delivery market is dangling discounts on food and drinks to attract customers and taking a bite out of the share prices of the three big industry rivals.

Shares in dual-listed Alibaba, which entered the market in May with a round of price cutting, have dropped 6.5 percent in both New York and Hong Kong. Meituan, China's largest delivery platform, declined 5.6 percent to a one-year low in Hong Kong, while JD shares there retreated 3.5 percent.

The three giants rank from third to fifth on the Hang Seng TECH index that tracks the 30 biggest technology companies listed in Hong Kong. They now account for nearly 20 percent of the index weighting. The TECH index has come to be called the "takeaway index" in the past week because of high volatility caused by the trio.

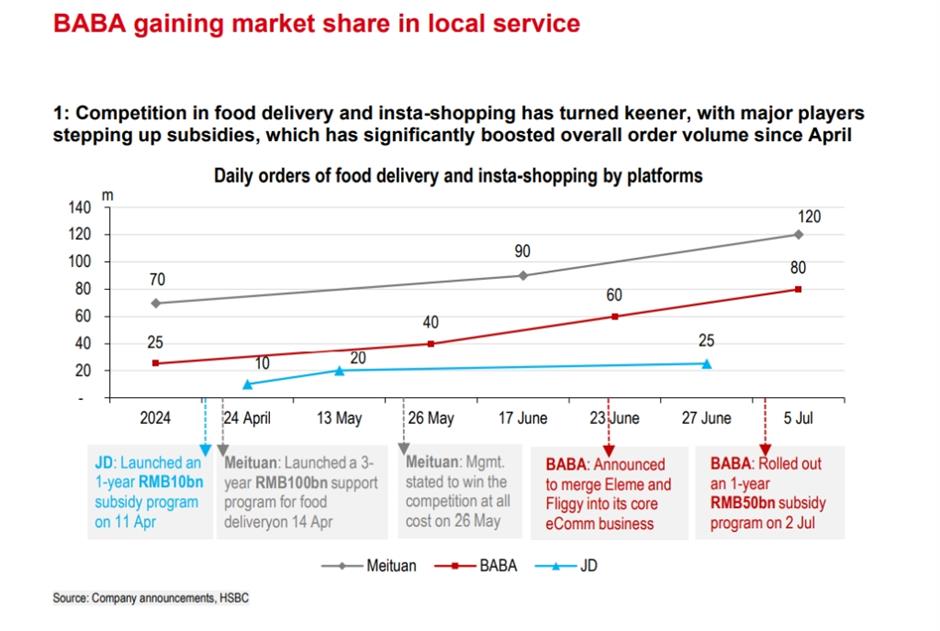

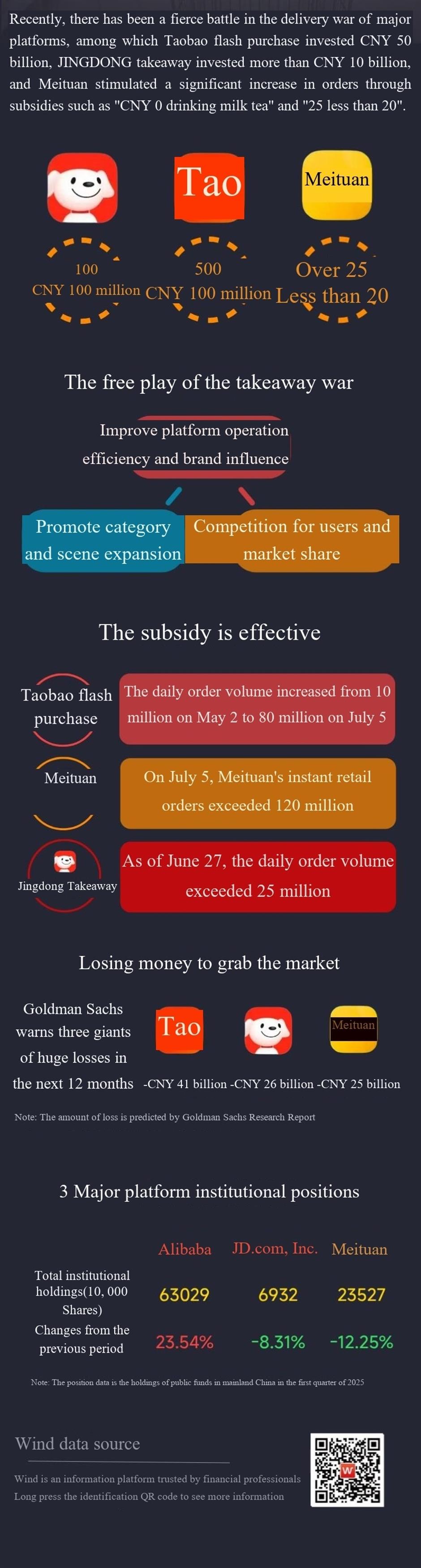

What's clear is that this price war involves impressive sums of money.

Alibaba newcomer Taobao Flash Buy said last week that it plans to invest 50 billion yuan (US$6.9 billion) in discounts for consumer and subsidies for merchants in the next 12 months.

It is drawing on the user base of Alibaba's Ele.me platform. Taobao Flash Buy announced an astonishing 80 billion daily orders on July 5, a steep rise from its previous record of 60 million on June 23.

Not to be outdone in a market that promises delivery within 30 minutes of an order, Meituan released coupons offering even lower prices, with the extreme of sending drinks for free to stimulate demand.

Its platform was flooded with orders, rising to a record 120 billion on July 5. The food delivery sector in China is expected to surge in value to 2.4 trillion yuan by 2030, providing ample fuel for a heightened competition

Meituan, which has enjoyed a 70 percent market share, first felt the heat of competition when JD entered the fray in February.

The e-commerce giant promised to provide its deliverymen social security benefits that include unemployment and retirement payments – a big incentive for workers whose earnings depend on numbers of completed deliveries.

Liu Qiangdong, founder and board chairman of JD, delivered food boxes to some customers in April, saying he wanted first-hand experience in how services are working. A photo of him in a delivery uniform became an instant online hit.

In May, Chinese regulators stepped in, asking companies in the food delivery sector to refrain from self-defeating competition.

The admonition hasn't seemed to impede the price war. On Tuesday, JD.com pledged 10 billion yuan to support its benchmark brands across various categories.

Analysts say the three companies are "burning money" to drive up consumer traffic in a competition that is not sustainable. Still, with daily takeaway orders surpassing 200 million, it's clear that consumer are in no hurry to see an end to it.

On Thursday, Meituan released a statement denying rumors that it has hired 300,000 college students as extra riders. But it didn't deny crashes of its online order system during peak hours in the previous few days.

Also on Thursday, US investment bank Morgan Stanley lowered its target price for Alibaba's US depository shares, citing pressure on earnings from the company's huge investment in food delivery services.

Goldman Sachs warned in a report that fierce competition in the food delivery sector could persist until September, resulting in significant losses for the three companies.

The bank projected delivery-related losses of 41 billion yuan for Alibaba and 26 billion yuan for JD.com over the next 12 months. It also forecast that Meituan's earnings before interest, tax, depreciation and amortization would decline by 25 billion yuan over the same period.

Market observers see a parallel with what happened in China's ride-hailing industry a decade ago.

Before 2015, Didi Chuxing, Kuaidi and Uber China were the three major players in China's ride-hailing industry, along with more than 40 smaller companies. Then Didi Chuxing took the lead by initiating a huge campaign of discounts.

Vicious price cutting ensured, eliminating most smaller rivals but also crimping profits of the big three. In 2015, Didi merged with Kuaidi, and a year later, it acquired Uber's China business, restoring market order and putting an end to the price war.

For the current "takeaway war," Goldman Sachs predicts three scenarios.

Its baseline projection has Meituan successfully defending its market leadership, based on customer loyalty, distribution network advantages and better coverage in smaller cities.

The second assumption sees a Meituan-Alibaba duopoly, with Alibaba Flash Buy gaining significant market share through its 50-billion-yuan investment and the strength of its existing e-commerce platforms.

And the last paints a picture of three-way competition surviving, with Meituan first, Taobao second and JD third, thanks to its improved merchant coverage and investment in its 150,000 full-time riders.

No matter what transpires, there have been collateral benefits for companies catering to the beverage segment of the food industry.

Orders are surging at Hong Kong-listed bubble tea chains, with Chabaidao shares up 29 percent in the past five days, followed by Good Me with a 15 percent rise and Mixue gaining 7.5 percent.

In Case You Missed It...