China has over 400 million overweight adults. With GLP-1 drugs, many now see a syringe as the path to slimming down.

Fatness, once a scourge only in advanced Western countries, is no stranger to China nowadays, with an estimated 400 million overweight or obese adults. Small wonder that the nation's pharmaceutical companies have joined foreign rivals in racing to develop drugs that help people lose weight.

Forget gym memberships, salad diets or self-control, China's middle class has discovered that the faster way to weight loss comes in a pre-filled syringe. It's a huge market for domestic drug companies.

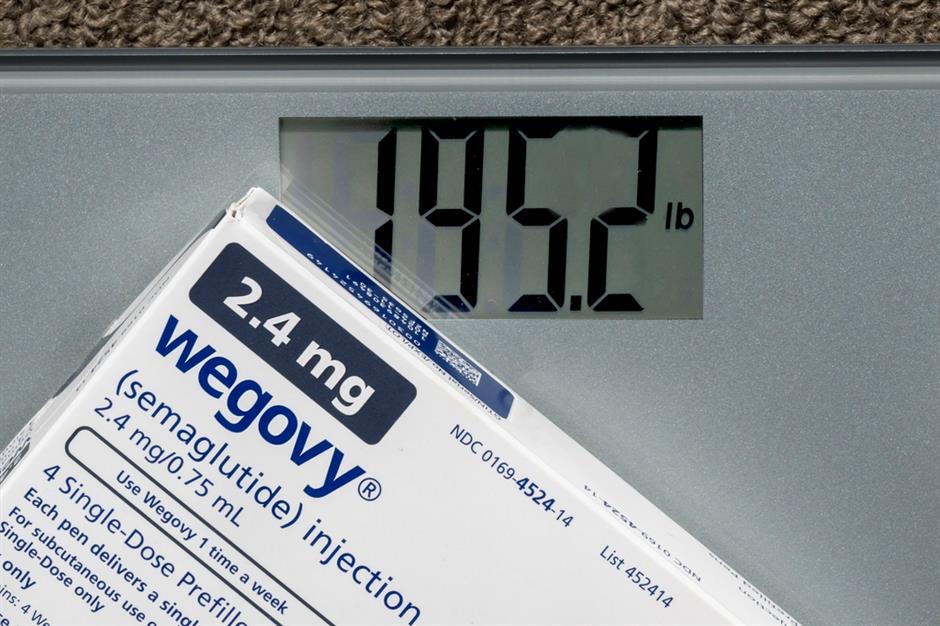

As Danish pharma giant Novo Nordisk's Wegovy brand of semaglutide smashes global sales records, Chinese pharma companies are no longer standing idly. One Chinese pharma company has just launched its first semaglutide version. Another is building drug-manufacturing factories even before clinical trials are completed. And local governments are now treating weight management as a civic duty.

Novo Nordisk's semaglutide, branded as Wegovy, has become a global weight-loss sensation. China's homegrown rivals are racing to catch up.

Stocks investors are piling into domestic pharma share, betting on big returns.

Originally developed to treat Type 2 diabetes, semaglutide mimics a nature hormone called GLP-1, or glucagon-like peptide, which tells the brain you are full, slows digestion and improves insulin response. People using the drug have been shown to lose up to 15 percent of their body weight in under a year, with results often showing up within weeks. It's weight loss backed by science. No treadmill required.

"The GLP-1 class has the potential to crown the next generation of blockbuster drugs," said Chen Tielin, a pharmaceutical equity analyst. "For the China market, this is more than a moment of innovation. It could mark the beginning of the country's pharmacological weight-loss era. For Chinese drugmakers, it's both a catch-up game and a chance to leapfrog."

Chasing GLP-1 gold

Indeed, more than 60 GLP-1 drugs are in development across China, with over 20 companies chasing semaglutide generics. Industry heavyweights like Innovent Biologics, Huadong Medicine, Jiuyuan Gene and Hengrui Pharmaceuticals are deep into clinical trials.

With semaglutide's China patent set to expire in 2026, the window is wide open, and local drug companies are moving quickly to grab a share of a market projected to swell to 40 billion yuan (US$5.5 billion) by 2030.

China is viewed as the world's largest untapped markets for such metabolic therapies.

In recent months, Shanghai and other local governments have begun including obesity and the prevention of other chronic diseases into their health policies. That shift is fueling broader acceptance of pharmacological solutions and positioning GLP-1 therapies as more than a just weight-loss fad, but rather a long-term tool for managing a growing national health problem.

Innovent Biologics last month made headlines with Mazdutide, the first Chinese-developed dual-target GLP-1/GIP agonist to reach the market. Approved in June, the drug offers weight-loss efficacy comparable to versions sold by Novo Nordisk and Eli Lilly, at a price tag that could appeal to cost-conscious consumers.

Meanwhile, Huadong Medicine, a company with established diabetes franchises, has advanced one of its GLP-1 candidates into Phase III trials. In April, its new drug application for a semaglutide injection was officially accepted by the National Medical Products Administration.

Hangzhou-based Jiuyuan Gene has partnered with academic institutions to accelerate development, while Jiangsu Province-based Hengrui is leveraging its next-generation delivery platforms, including oral GLP-1 formulations and dual/triple-agonist injections, to build a competitive edge in both efficacy and patient convenience.

Getting the jump on final approvals

Of the 60 or more GLP-1 drugs in the pipeline across China, some are biosimilar, while others are so-called "me-betters" that tweak the molecule for longer efficacy or fewer side effects. Several players are already pouring money into manufacturing facilities ahead of time, betting that supply won't catch up with demand anytime soon. That urgency now extends far beyond labs and boardrooms. Across the country, hospital clinics are feeling the pressure from patients seeking weight-loss therapeutics.

With obesity now seen as a national health challenge, local governments are pushing exercise, diet and increasingly, medical solutions.

"I probably now prescribe more GLP-1 drugs than some endocrinologists," said Han Xiaodong, an obesity surgeon at Shanghai's Sixth People's Hospital. He noted that many of his patients fall into a gray zone – overweight but not obese enough for surgery, and often discouraged by failed diets and gym routines.

"For these patients," he said, "the drug is not a shortcut; it's a bridge. It gives them just enough physiological help to regain control over their weight."

But Han is also cautious.

"Roughly 60 to 70 percent of GLP-1 inquiries we get aren't suitable," he said. "Some people have unrealistic expectations, thinking one injection will solve everything. Others don't meet the clinical criteria, and using the drug could even backfire."

Still, he said he believes GLP-1 therapies mark a turning point in how China approaches obesity, not as a cosmetic issue but as a chronic disease requiring sustained, medical-grade intervention.

This real-world enthusiasm is mirrored in China's stock market.

Shares of companies with GLP-1 pipelines have soared in recent months, as investors bet on a new generation of blockbuster drugs.

Leading the pack is Changshan Biochemical Pharmaceutical, whose shares have skyrocketed 152 percent this year. Shengnuo Biotec and BrightGene Pharmaceutical are not far behind, with gains of 86 percent and 69 percent, respectively. Huadong Medicine has jumped 28 percent since January.

But investors should keep their expectations in check, warned analyst Chen.

"Most of the domestic GLP-1 candidates for obesity are still in the clinical phase," he said. "That means the risk of delays, or outright failure, is real."

And with an increasingly crowded playing field, competition is only going to intensify, he added.

For now, the stock market is rewarding optimism. But as clinical deadlines approach, the difference between hope and hype may become harder to ignore.