Payments in China are now done mostly online and through apps, which has made life easier.

Even before coming to China, international travelers can use their foreign mobile number to register in Alipay and bind their foreign bank card (both debit and credit cards) to make mobile payment in China.

TourCard, Alipay and UnionPay are some of the mobile payment services available in Shanghai.

TourCard

Bank of Shanghai's TourCard is specifically designed for overseas travelers who can bind their international bank cards (both debit and credit) to make mobile payment in China.

You can not apply for the service until you land in China.

Step 1: Search "TourCard" in Alipay or WeChat mini-programs.

Step 2: Verify your personal information.

Make sure all the information is valid and matches the passport or other relevant documents.

Step 3: Top up money.

Currently, TourCard supports VISA, MasterCard, Diners Club International and JCB.

It will support American Express in the future.

Step 4: Show your QR code to merchants with the UnionPay logo to make payment.

Or bind your TourCard with Alipay or WeChat Pay for online or offline consumption.

Note:

1. TourCard expires 180 days after it is issued.

2. Currently, you can top up only 10,000 yuan on TourCard.

Alipay

Alipay is China's equivalent to PayPal, providing users with e-wallet services.

Most restaurants, cafes, supermarkets, malls, hotels, trains, planes and hospitals accept Alipay for payments.

Here are two ways to use Alipay in China.

1. Users must bind their overseas credit cards to Alipay.

Step 1: Registration

Download Alipay app, open it and click "sign up" to register.

Step 2: Verification

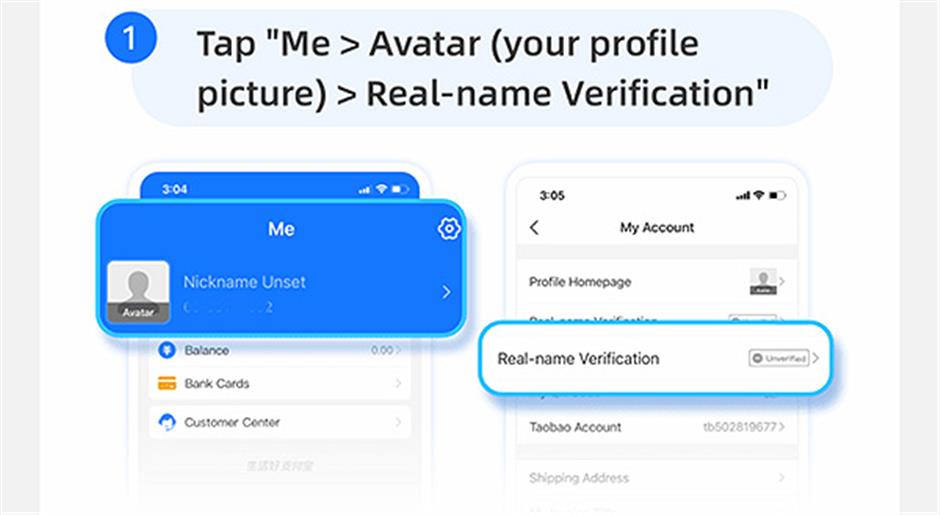

Tap on "Me," click your Avatar (image), and find "Real-name Verification."

Step 3: Adding bank card

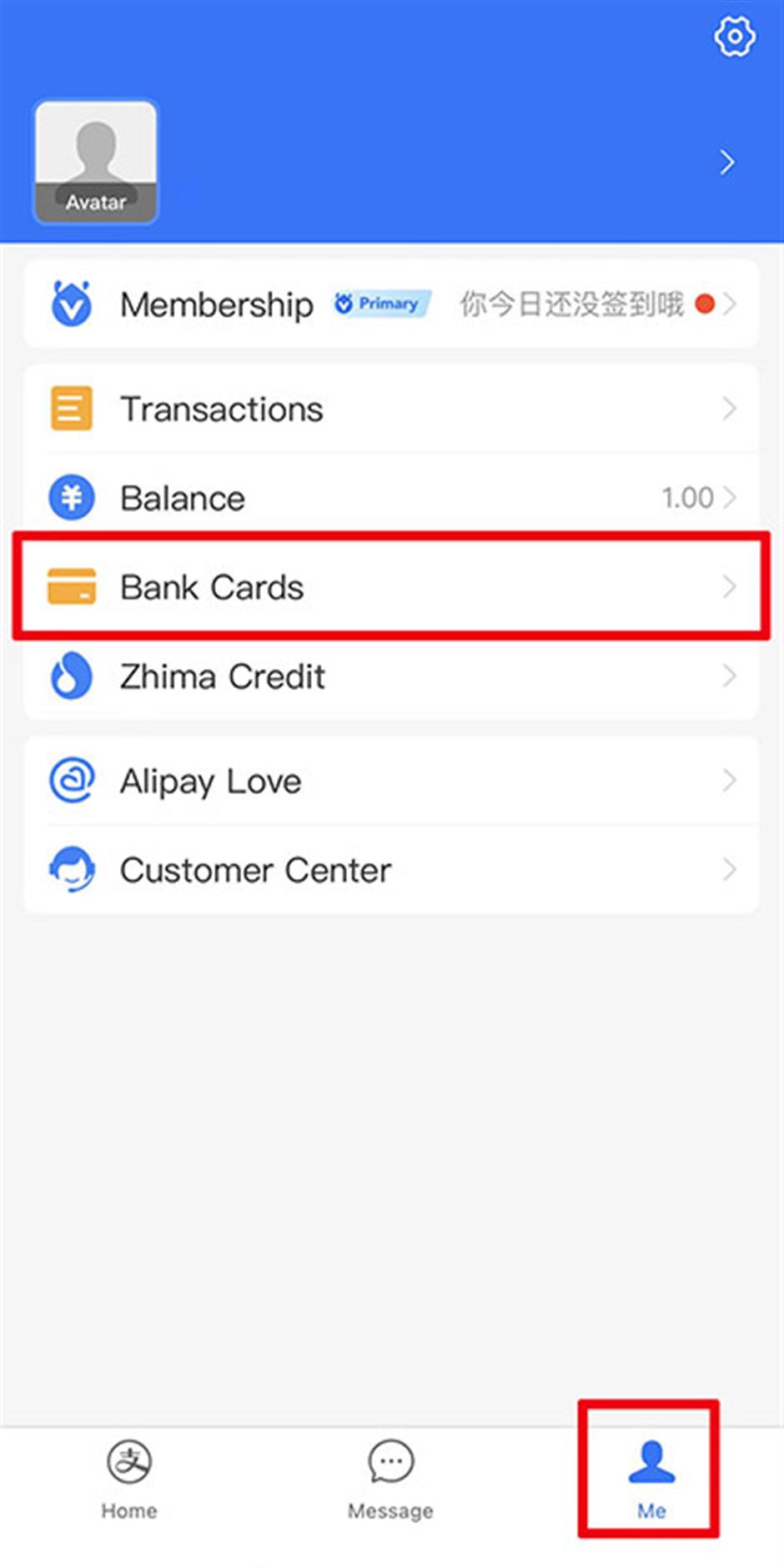

In the lower right corner, tap "Me," "Bank Card," "Add card," and then follow the on-page prompts to add your card.

It supports VISA, Mastercard, Dinners Club and Discover.

Step 4: Make payment

Tap "Scan" to make payment on the merchant's QR code.

Or tap "Pay/Collect," then present your QR code to the merchant.

Note:

1. If there's any issue, call Alipay's hotline 95188, which provides 24/7 service in English.

2. Daily purchases within the Chinese mainland are supported, while wealth management or transfers are not supported at the moment.

3. Currently, overseas credit card payments are limited to a single transaction limit of 3,000 yuan (US$425). It has a monthly cumulative limit of 50,000 yuan and an annual cumulative limit of 60,000 yuan per account.

4. The exchange rate for overseas credit cards is provided by the card companies and the issuing banks.

5. There is a transaction fee for using overseas credit cards. However, the fee is waived for transactions under 200 yuan. A 3-percent transaction fee is charged for every transaction over 200 yuan.

2. Users from China's Hong Kong, South Korea and Malaysia can pay from their overseas e-wallets.

They can use their overseas mobile payment methods linked with the Alipay+ system to make QR code-based payments in China, without downloading the Alipay app and binding their overseas bank cards.

Alipay+ has partnered with Asian wallets such as AlipayHK (Hong Kong), KakaoPay (South Korea) and Touch'n Go (Malaysia).

UnionPay

UnionPay, the umbrella body for all card payment and ATM services in China, accepts online and mobile payment. UnionPay's mobile payment service is available for utility payments, restaurants and takeaways, buses, airlines, hotels, and tourist attractions, making life easier in China.

Here are three examples of how to use UnionPay:

1. Use your overseas UnionPay cards in China for cash withdrawals as well as online and offline purchases.

2. Add your UnionPay cards to your overseas e-wallet apps in order to make NFC contactless payments, QR payments, and online payments on mobile devices without having to open any apps.

UnionPay mobile payment services are available through BOCPay (Hong Kong), PayLah! (Singapore), UMobile (Malaysia), KakaoPay (South Korea), K Plus (Thailand), and a number of other products.

UnionPay International has also partnered with PayPal but the service is not available on the mainland yet.

3. Users from China's Hong Kong, Macau and Taiwan, South Korea and Japan can make QR payments and in-app purchases online or in-store using the international version of the UnionPay app.

To activate your UnionPay app

Step1: Scan (below) and download the UnionPay app.

Step 2: Register

Select "Me" and then "Register." Fill in your foreign mobile phone number, enter SMS verification.

Step3: Add cards and complete real-name authentication

1. Select + in "Cards" to either enter the card number or scan the bank cards..

2. Fill in personal information.

3. Enter SMS verification code.

4. Type in and confirm your payment password.

Tips

Bank of China

Aside from that, foreigners can withdraw yuan from most Chinese ATMs using their overseas bank cards. Overseas cards are accepted at more than 91 percent of Bank of China ATMs in Shanghai.