China Launches First National Drug Price Registration System

China has rolled out its first national drug price registration and query system, a move that could fundamentally reshape how innovative medicines are priced domestically and referenced globally.

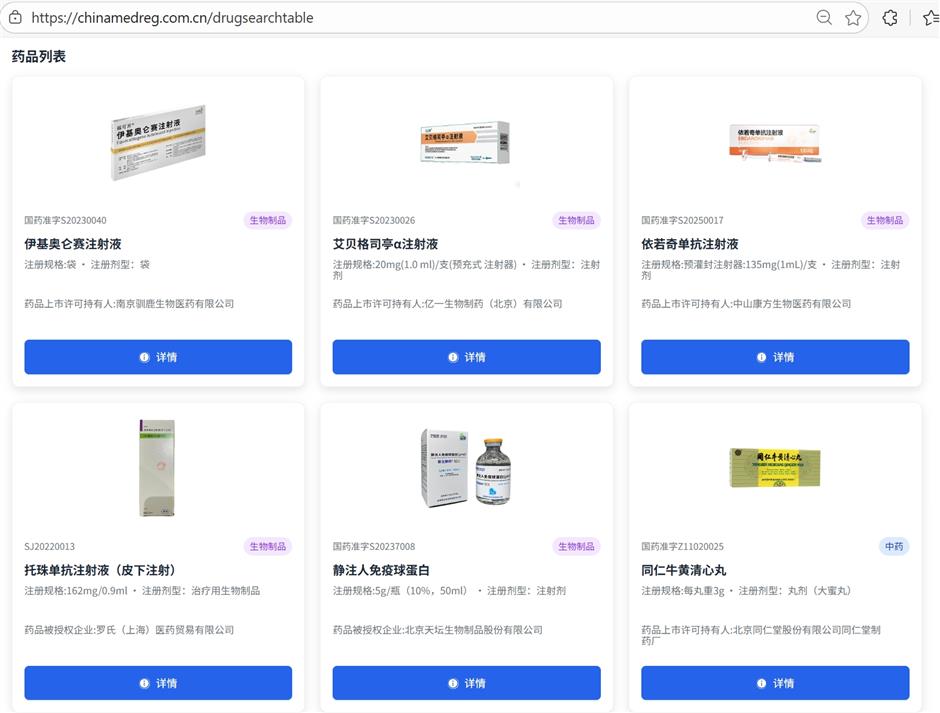

The National Healthcare Security Administration (NHSA) announced earlier this month the official launch of the China Medicine Registration System (chinamedreg.com.cn), allowing domestic and foreign pharmaceutical companies to voluntarily register drug prices independent of provincial procurement platforms and national reimbursement negotiations.

For the first time, China is establishing a national, publicly accessible market price system that exists outside its tightly managed reimbursement framework, marking a departure from a model in which government-negotiated prices effectively became the country's de facto drug pricing benchmark.

"This is China's first openly transparent pricing system where companies determine prices based on the market," said Yu Wei, professor at the Research Center for Healthcare Policy and Management, Shanghai University of Finance and Economics. "Previously, drug prices were largely shaped by administrative mechanisms, including price caps, reimbursement negotiations and provincial procurement platforms."

Under the new system, companies can file standardized information, including drug type, specifications and prices, creating a "one drug, one file" database available to registered institutions and the public. The platform is designed to reflect actual transaction prices rather than reimbursement levels.

The registry formalizes what is already common practice in major developed markets: a dual pricing mechanism.

One price is a publicly visible market price, used for reference and comparison. The other is a confidential reimbursement or insurance payment price, typically negotiated below the list price and used for settlement.

China's system has long lacked a national-level public market price, leaving reimbursement prices, often sharply discounted through national negotiations, exposed through provincial tendering platforms. Over time, these reimbursement prices became the only visible benchmark, effectively anchoring domestic drug valuations.

"The listed price is a self-pay market price and should naturally be higher than the reimbursement price," said Hu Jiahao, assistant researcher at the Shanghai Health Development Research Center. "The new system records market prices with actual transaction history. It does not interfere with later reimbursement negotiations, nor does it undermine drug affordability."

Importantly, prices registered on the platform are independent of reimbursement ceilings and do not affect future negotiations with the NHSA.

Nine pharmaceutical companies have participated in the first round of registrations, including Roche, the only multinational drugmaker so far, and several Chinese companies focused on innovative therapies. Two-thirds of participants are Chinese firms, ranging from established players transitioning from generics to innovation to biotech companies founded around novel drug development.

As of now, the system has recorded 10 products: one chemical drug, one traditional Chinese medicine, and eight biologics. Prices range from 280 yuan (US$40) per box for Chinese herbal pills to 10,688 yuan per box for a PD-1 antibody injection.

This limited initial scope reflects a cautious rollout, with broader adoption expected as companies gain clarity on how the registered prices will be used by markets, investors and overseas partners.

Beyond domestic reform, the registry may carry significant implications for Chinese pharmaceutical companies expanding overseas.

In recent years, China's growing influence in biopharmaceutical innovation has coincided with a rising role in international reference pricing, where countries use prices from other markets to guide domestic drug pricing. The exposure of China's deeply discounted reimbursement prices has often weakened Chinese companies' bargaining power in overseas licensing and commercialization negotiations.

"Internationally, some countries reference prices from markets like China," Hu said. "If a drug launched at 500 yuan is later reimbursed at 100 yuan, the lower number has effectively become the global reference. With this system, the publicly visible price would be the market price, not the insurance payment."

By decoupling market prices from reimbursement outcomes, the system could help Chinese innovators maintain higher reference prices abroad, particularly in license-out transactions.

According to industry data, Chinese pharmaceutical companies completed 103 overseas licensing deals in the first three quarters of 2025, with total deal value reaching US$92.03 billion.

"In essence, China now has a nationally endorsed market price," Hu said. "This replaces fragmented provincial data and corrects a long-standing structural gap in the pricing system."

In Case You Missed It...

![[Expat & Aliments] Expats Can Sign Up for a "GP" Doctor. Here's How..](https://obj.shine.cn/files/2026/03/04/0cbf7ce4-74fb-46f8-8917-4ab61b8403c7_0.png)