European Firms Seize Opportunities in Changing, More Open China Market

Norwegian company Northern.tech first began serious research on the Chinese market in late 2024, intending to serve European and American clients doing business there. A few months later, the Oslo-based cybersecurity company decided to enter the market itself and was so confident that it set a goal of achieving one-third of its revenue from China.

"We are very optimistic and confident about it," Shoaib Zafar, the company's head of global operations, told China Biz Buzz on his recent visit in Shanghai.

"Chinese tech potential is limitless, especially in Shanghai," he said. "We have a niche in the market. We focus on the device lifecycle management to ensure the security for any device that can be connected through Wi-Fi. China undeniably has an amazing ability to build very smart devices on a large scale."

Northern.tech's entry reflects a strategic pivot of many European companies who are waking up to significant changes and new opportunities in the Chinese market, particularly in technology and consumer segments.

As geopolitical uncertainties persist and tariffs affect global trade, the Chinese market remains a stable attraction. In the first half of 2025, total retail sales in China reached 24.55 trillion yuan (US$3.41 billion), up 5 percent from a year earlier.

The nation's increasing prominence in technology and constantly changing consumer trends open new doors but also mean that long-established, well-performing foreign-invested companies can no longer rest on their laurels. It is no longer a one-size-fits-all market.

A recent survey by European Union Chamber of Commerce in China, focusing on smaller and medium-sized companies, cited competition with private Chinese companies as the top challenge for European business. That was followed by issues such as cashflow, rising operational costs, and talent attraction and retention.

"China is currently the most vibrant and interesting market in the world," said Victor Escobar, managing director of the China unit of UK-based Renishaw, one of the world's leading engineering and scientific technology companies.

"It is highly competitive, fast moving and incredibly demanding. I think a high percentage of people in the Western world still don't know what is really happening here. It's not just a question of size and scale. It's also about the strategic vision for economic growth."

The company, which specializes in industrial precision measurement, entered the Chinese market more than three decades ago and now has 15 offices around the country. It is still growing in double digits, with "expectations for the future very good," Escobar said.

One factor behind his confidence lies in China's accelerating process in moving up the value chain, which provide new opportunities for Renishaw products.

"Humanoid robots are a very good example," he said. "In many countries, it's just a cool trend, but in China, it's going to be a big business."

He said he expects China's race for technological self-sufficiency to be fulfilled faster than previously expected, and noted that the company is already seeing an emergence of local competition.

"Competition is good, not only good for users, but also good for manufacturers," he said. "It forces us to keep working hard to make sure that we are always leading and innovating. Now is the time to make the right decisions to make sure we continue to grow in the future."

One decision Renishaw is currently weighing is whether to build manufacturing facilities in China for the first time, he said.

Chinese authorities continue to widen foreign access to mainland markets, with policies that loosen restrictions, promote more balanced trade and encourage pilot projects.

"Foreign investment plays a very important role in the development of new quality productive forces in China and in the achievement of Chinese-style modernization," Ling Ji, vice minister of commerce, said earlier in the year when introducing a 2025 plan for stabilizing foreign investment.

One aspect that has concerned many foreign-invested firms is a seat at the table in the development of industry standards in China. By the end of 2024, foreign representatives have participated in the work of 837 technical committees looking at professional standardization, accounting for 61 percent of membership.

Although the amount of foreign direct investment deployed in China has declined somewhat, the number of companies entering the Chinese market is on the rise. In the first half of 2025, their number rose 14 percent from a year earlier. In 2024, technology industries attracted nearly 35 percent of foreign investment.

China's green development goals also open new opportunities for many European companies.

"Globally, the share of nuclear power in the energy market will definitely increase," said Jean-Marc Capdevila, president of the China arm of Framatome, the nuclear engineering group that is majority owned by French energy giant EDF, the world's largest nuclear power operator.

"We see tremendous potential in China. Its commitment to peak carbon emissions before 2030 and carbon neutrality by 2060 creates a strong framework for the expansion of nuclear energy as a key component of the clean energy mix."

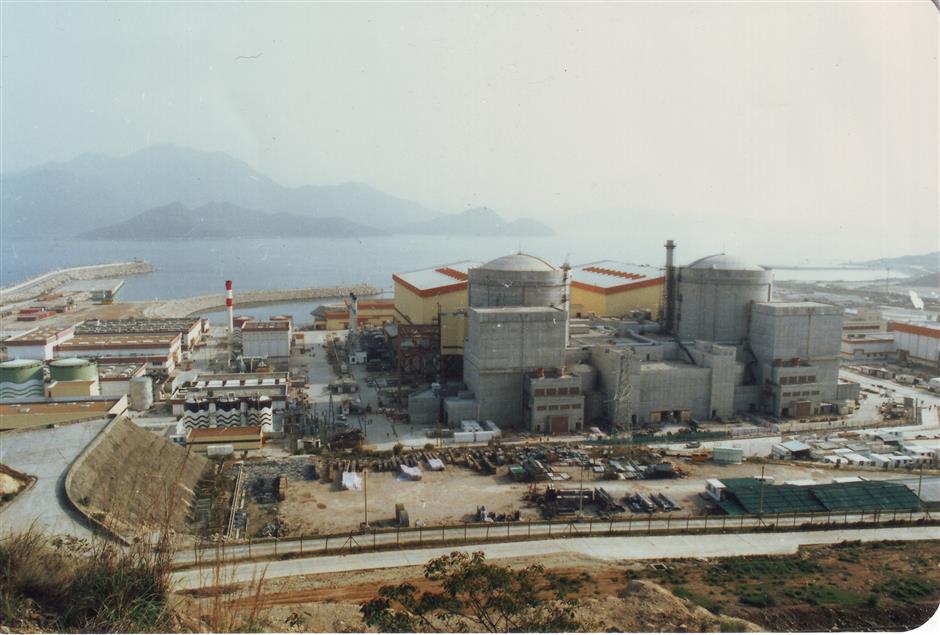

Framatome, whose business ties with China began in 1978, has participated in the construction of several Chinese nuclear power plants, including Daya Bay in Guangdong Province. The company has two joint venture manufacturing sites in China, including one in Shanghai.

At the recent 8th China International Import Expo in Shanghai, the company announced it had secured multiple orders from China National Nuclear Corp and China General Nuclear Power Group, covering fuel, control system components and technical services. No details of the value of the contracts were made public.

"We will continue to invest a lot in China and not only in building reactors," Capdevila said. "We ultimately view our role in China not only as a supplier but as a trusted local partner – working hand in hand to advance innovative, safe and sustainable energy for generations to come."

Shanghai is often the first choice for European companies doing business in China. A recent EU Chamber of Commerce's survey of Shanghai found 64 percent of members reporting ease in doing business in the city and 74 percent viewing the city as an ideal location for research and development facilities.

Northern.tech's Zafar said he formerly thought that "China is open to investors, but only simple if you are big and investing a lot of money." That's no longer his view. After laying the groundwork for his company's Shanghai subsidiary, he reckons the firm can achieve the same success in China as it has in the US and Europe.

His advice for other companies weighing up entry in China? "Don't just rely on online searches. Visit in person and find the right people to give you clear answers to questions you may have."

In Case You Missed It...