China Markets Withstand Global AI Slump on Visions of Tech Future

The wave of concern about overvaluation of AI-related stocks didn't sink Chinese shares this week despite declines on global markets. Investor sentiment toward new technologies has been buoyed by two high-profile Chinese mainland events showcasing visions of the digital – the China International Import Expo and the World Internet Conference.

"AI companies are on show at almost all important occasions this year, and they are successfully raising awareness for the sector among both investors and users," said Cao Haihua, an analyst with Changjiang Securities.

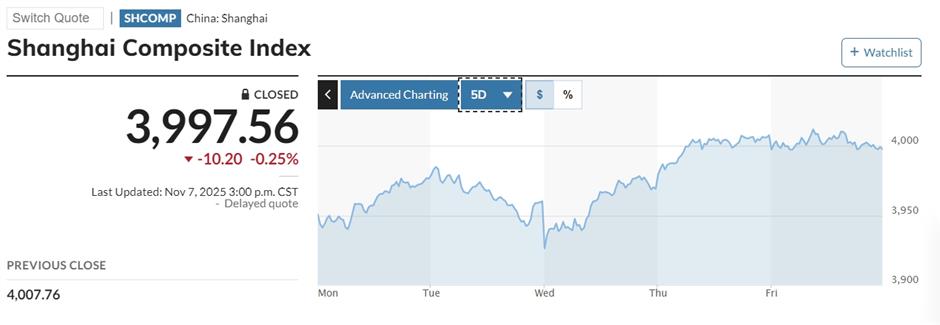

The benchmark Shanghai Composite Index slipped 0.25 percent to 3,997 on Friday but posted a 1.1 percent gain for the week, though it still struggled to close above the psychologically important 4,000-point milestone.

The Shenzhen Component Index fell 0.36 percent on Friday and rose 0.3 percent for the week, while the ChiNext for tech startups slipped 0.5 percent.

At the China import trade fair in Shanghai, well-known Chinese academic Victor Gao said China has paved the way for the sustained development of artificial intelligence with sound infrastructure, including adequate electricity generation, and thousands of companies embracing the opportunities of AI technology. At the World Internet Conference, JD Chairman Liu Qiangdong predicted robotic delivery systems could lead to some people working just one day a week in the future.

The performance of Chinese listed companies also lifted investor sentiment, after China Merchants Securities said third-quarter earnings results are showing their fastest growth of the year.

Hong Kong's Hang Seng Index retreated 0.92 percent on Friday but concluded the week with an increase of 1.3 percent. Elsewhere in Asia, the global pullback in technology shares bit markets. Japan's Nikkei slumped 4.1 percent for the week while South Korea's Kospi lost 3.5 percent.

In New York, the tech-heavy Nasdaq dropped about 3 percent this week, its worst five-day performance since April, and the S&P 500 and the Dow each lost more than 1 percent. Apart from AI valuation concerns, US trading was affected by the 10 percent reduction in air flights at 40 major airports because of the continuing government shutdown, an index on consumer sentiment that fell to near record lows and a report from placement tracker Challenger, Gray & Christmas that layoff announcements in October rose to their highest level in 22 years.

In Europe on Friday, all major stock markets fell, with the Stoxx600 index losing 0.6 percent.

In Case You Missed It...