'China's Nvidia' symbolizes the explosion of investment in artificial intelligence

Shares in Cambricon Technology, August's "king" of the Chinese stock market, fell from their brief reign as the Chinese mainland's most expensive stock but remain a symbol of a new era of investment in the transition of artificial intelligence from the lab to capital markets of the world's second-biggest economy.

On August 28, shares of Shanghai-based AI chipmaker Cambricon, sometimes dubbed "China's Nvidia," closed at 1,587.91 yuan (US$217.70), knocking premier liquor maker Kweichow Moutai from its decade-long status as China's priciest stock. However, Cambricon shares have since fallen, ceding the title back to Moutai.

Cambricon wowed investors in August when it reported first-half revenue skyrocketed 43 times from a year earlier.

"The AI sector is experiencing a significant wave of growth, driven by improving profit expectations and a shift in industry trends," said Meng Lei, UBS Securities China Equity Strategist. He also noted that individual, leveraged and quantitative investors now account for a higher proportion of the market, and these investors tend to favor technology-related companies.

Another key driver is strong state-level support for the AI sector, particularly in the face of US trade barriers, such as the ban on Nvidia's H20 chip exports to China earlier this year.

With the rise of AI applications and increased domestic investment in digital infrastructure, the demand for computing power is surging, boosting demand for hardware like AI servers and switches. Sinolink Securities said the long-term process of domestic chips replacing imports is irreversible and mainland chipmakers are ramping up production to fill supply gaps.

Why Cambricon?

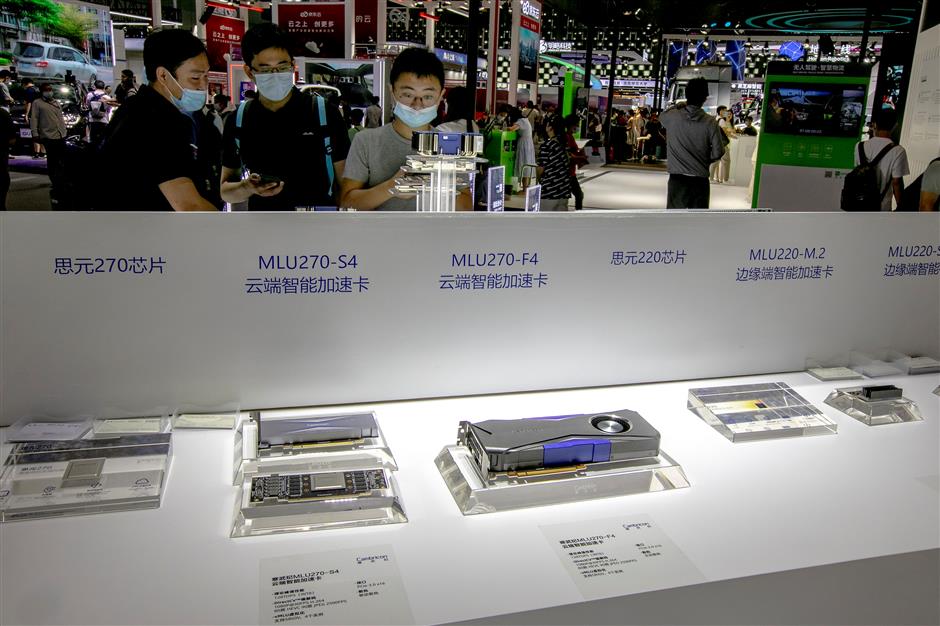

Beijing-based Cambricon, founded in 2016 by two computer PhD graduates working at the Chinese Academy of Sciences, stands out as a rising star in the sector for several reasons.

First, there were those explosive first-half results, when the company turned to a profit of 1 billion yuan from a year-earlier loss of 530 million yuan, on 2.9 billion yuan of revenue. In response, Goldman Sachs raised its 12-month price target for Cambricon to 2,104 yuan, citing robust results and expectations for increased AI chip shipments.

The company's continued investment in research and development is expected to solidify its market leadership and attract new clients, including more Chinese Internet and cloud service providers.

Market exclusivity is another factor. While many AI companies pursue initial public offerings, Cambricon is one of a few publicly traded companies where mainland investors can buy into the AI chip sector. Other promising makers of graphic processing units, like MetaX and Moore Threads, are still in the pre-IPO process. This scarcity of investment options, combined with the company's strong financial performance and robust industry demand, makes Cambricon "a compelling investment," noted Kenneth Fong, Head of China Internet Research,UBS.

Cambricon is not so much an isolated success story as it is a symbol of the rapidly emerging AI ecosystem in China. The upstream supply chain is also flourishing. China's largest chipmaker, Semiconductor Manufacturing International Corp (SMIC), reported a 40 percent jump in first-half net profit, with revenue climbing 23 percent. Cambricon's clients rely on firms like SMIC to manufacture their designs.

Furthermore, Hygon Information Co, one of China's leading AI chipmakers, saw a 45.2 percent increase in first-half revenue. The company's planned acquisition of server manufacturer Dawning Information Industry Co (Sugon) in a 116 billion yuan share-swap deal will strengthen China's in-house advanced computing ecosystem, spanning from chips to server systems.

The momentum extends across the supply chain, with companies in optical communications also seeing significant growth. Zhongji Innolight, a provider of high-speed optical transceiver modules and a key player in the Nvidia supply chain, recently saw its market cap surpass East Money to become the second-largest company on the ChiNext board, behind only CATL. This broad-based growth, from chip design and manufacturing to downstream components, underscores the strength in China's AI industry.

Outlook and risks

Looking ahead, Citic Securities said it believes the current semiconductor cycle is still on an upward trajectory, with AI service as the biggest growth driver. The investment logic can be divided into two main themes: domestic replacement for cloud-based AI and a surge in demand from consumer AI applications.

However, risks persist. Major tech companies like Alibaba and Meituan are exploring their own in-house chip development, which could challenge Cambricon's market position. Additionally, the accelerated IPOs of other domestic chipmakers will introduce powerful competitors. The stock's recent volatility highlights the difference between a high-growth tech stock and a stable value stock like Moutai.

Ultimately, while Cambricon's brief surge past Moutai made headlines, its true importance lies in what it represents: a landmark moment toward full-fledged capitalization of China's AI industry. It's a development that is certainly capturing excitement among investors.

In Case You Missed It...

![[Last Call] That Huge Muji Flagship Store is Having a Fire Sale](https://obj.shine.cn/files/2026/03/06/2ae5263a-6477-427a-90e2-ec451c473dd6_0.jpg)