The Rise of a New Generation: Asia at Heart of Rising Global Billionaire Numbers

In 2025, the world's billionaires crossed another symbolic threshold.

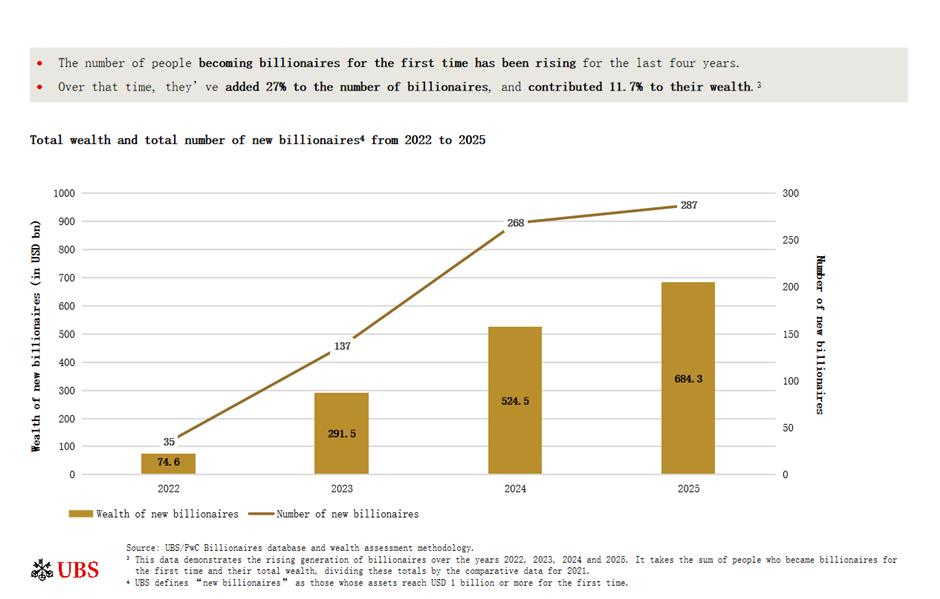

Their numbers rose to 2,919 people, while their combined wealth reached a record US$15.8 trillion, according to UBS's latest Billionaire Ambitions Report. Billionaire numbers rose by 8.8 percent, while total wealth expanded at a faster, double-digit pace. Yet the headline figures tell only part of the story.

What matters more this year is where the growth is coming from, and what kind of wealth is being created.

"This is a transformative era," said Marina Lui, head of Wealth Management China, UBS Global Wealth Management. "We titled this year's report 'The Rise of a New Generation' because we are clearly seeing a new pattern of wealth formation taking hold."

That pattern points east.

While North America remains the world's single largest pool of billionaire wealth, the momentum in 2025 shifted decisively toward Asia-Pacific. The region's billionaire wealth rose 11.1 percent to US$4.2 trillion, the fastest growth globally. At the heart of that expansion was the Chinese mainland.

China alone added US$321.4 billion in billionaire wealth during the year, pushing its total to US$1.8 trillion – a 22 percent increase, double the regional average. The country welcomed 70 new billionaires, bringing the total to 470, second only to the United States, which has 924.

More striking than the growth rate is the composition. Ninety-eight percent of China's billionaires are self-made entrepreneurs, one of the highest proportions globally.

"In this cycle of wealth creation, we are seeing more founders, more technology-led businesses, and more commercial innovation," Lui said. "China continues to be a market that creates new wealth."

Across Asia-Pacific, 79 percent of billionaires are self-made, the highest share of any region, underscoring a structural difference from Europe, where inherited wealth still dominates.

The sectoral breakdown reveals how that wealth is being built.

Globally, technology overtook consumer and retail to become the joint-largest source of billionaire wealth. Tech billionaires' fortunes expanded 23.8 percent to US$3 trillion, driven largely by artificial intelligence and advanced manufacturing themes.

Industrial wealth rose even faster – 27.1 percent, reaching US$1.7 trillion – boosted by electric vehicles (EVs), automation, and aerospace innovation. Roughly a quarter of that growth came from newly minted billionaires.

By contrast, consumer and retail wealth grew just 5.3 percent, as momentum in European luxury brands faded. Chinese brands and manufacturing-linked tech companies increasingly filled the gap.

"Tariff pressure has forced companies to move faster," Lui noted. "In high-tech sectors like AI and EVs, it's no longer optional. You have to innovate faster and do better."

At the same time, the global billionaire class is entering the largest wealth transfer period on record.

UBS estimates that US$6.9 trillion in billionaire wealth will change hands globally by 2040, with US$5.9 trillion likely to be passed to children. Asia is set to play a central role, though at very different speeds.

India is expected to see the largest inheritance wave in Asia, reflecting an older billionaire demographic.

China, by contrast, is moving more gradually. While heirs in the country are projected to inherit at least US$315.7 billion by 2040, many Chinese billionaires remain relatively young, and still focused on expanding their businesses.

"For now, the main topic among Chinese billionaires is still growth," Lui said. "They are building, not stepping back."

When succession does come, expectations are clear. Eighty-two percent of surveyed billionaires said they want their children to develop the ability to succeed independently, rather than relying on inherited wealth.

"Founders want their children to be entrepreneurs in their own right," Lui added. "Not just asset managers."

Another shift is reshaping how the ultra-rich think about time.

Globally, 44 percent of billionaires expect to live significantly longer than previous generations; in Asia-Pacific, that figure jumps to 68 percent. Advances in health care and biotechnology have made longevity planning a tangible consideration.

Longer lives complicate inheritance but encourage discipline. Among those expecting extended lifespans, 58 percent plan to regularly update wills and trusts, while 42 percent are making longer-term investments rather than focusing solely on short-term returns.

Family offices, wealth managers say, are increasingly central to managing these overlapping timelines of growth, succession and governance.

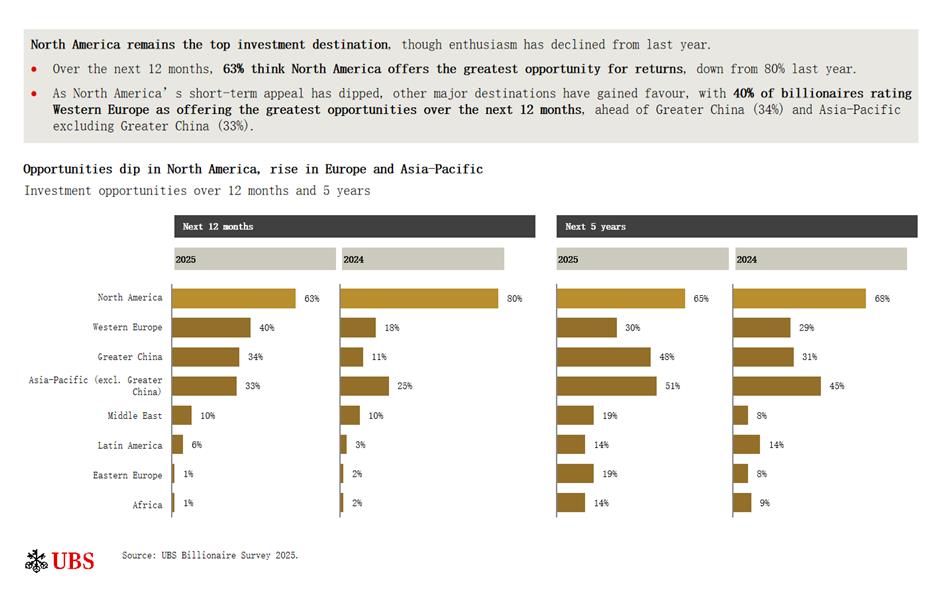

Investment preferences are also shifting.

North America remains the top destination for billionaire capital, cited by 63 percent of respondents, but enthusiasm has fallen sharply from 80 percent a year earlier. Valuations are high, competition in AI is intensifying, and returns appear less asymmetric.

Meanwhile, 34 percent of billionaires now view China as offering the best opportunities, up from just 11 percent in 2024. A further 33 percent favor Asia-Pacific excluding China.

Among Asia-Pacific billionaires, risk awareness runs high. They rank tariffs as their top concern for the year ahead (75 percent), followed by major geopolitical conflict (72 percent) and policy uncertainty (69 percent), according to UBS.

In response, many are tilting portfolios toward hedging assets: 61 percent plan to increase exposure to hedge funds, 50 percent to developed-market equities, and 48 percent to gold and precious metals.

"We're seeing more balance," Lui said. "Returns need to be realistic – above inflation, not excessive – but stable."

Taken together, the data sketches a quieter but profound transition. Wealth is still growing globally, but its sources, geography and mindset are changing. Asia – and China in particular – is no longer a peripheral contributor to global billionaire growth. It is increasingly the engine.

The new generation of billionaires is younger, more technology-driven, more globally minded, and more cautious about risk.

Editor: Liu Qi

In Case You Missed It...