China Investors Upbeat on Policy Pledges, Tech Shares Under Pressure

China's stock market recovered some lost territory on Friday after an economic meeting of national leaders pledged more support for domestic spending and the troubled housing market. But renewed global concern about huge corporate outlays for AI development dimmed optimism on technology stocks.

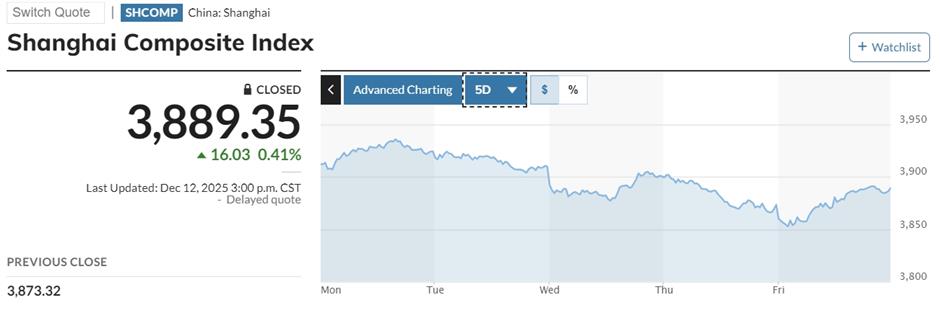

The benchmark Shanghai Composite Index rose 0.41 percent on Friday to end at 3,889 points. But for the week, it lost 0.34 percent. The Shenzhen Component Index and ChiNext both ended with small weekly gains after Friday rises.

"Investor sentiment was apparently bolstered by the messages delivered by the Central Economic Work Conference, which signaled consistent policies in a world still filled with uncertainties and fast changes," said Yang Chao, an analyst with Galaxy Securities.

At the economic conference this week, top leadership reiterated a commitment to high-quality growth, capital market reform, a stable property market and more incentives to encourage domestic consumption. The International Monetary Fund this week raised its China growth forecast for 2025 to 5 percent, in line with the government's target.

In Chinese mainland trading, shares in materials companies were among the biggest gainers. Tianli Clad Metal Materials, Ceepower and Sinocera jumped by the daily limits.

It was a different story for technology shares, which have suffered globally after US tech giant Oracle touched off a new wave of concerns that investment in AI may be running ahead of short-term returns. The company reported disappointing quarterly revenue on Wednesday but said capital spending on artificial intelligence will be US$15 billion higher than the earlier announced US$35 billion. Its shares plunged for three consecutive days.

On the Shanghai STAR Market, which is geared to technology startups, chipmaker Moore Threads dived 13.4 percent and Cambricon tumbled 2.75 percent. In a statement to the Shanghai Stock Exchange, Beijing-based Moore Threads warned investors that a surge in its share price may be running ahead of fundamentals. The company's shares have surged 723 percent from their offer price since they began listing on December 5.

Concerns are also bubbling in the property sector amid fears that China Vanke, once a leader in China's property development, may be headed toward what might be the nation's largest-ever bankruptcy proceedings. Bloomberg News reported that government support that has kept the debt-ridden company afloat may be ending. Shares in the company, which has US$50 billion in Chinese mainland and overseas debt, fell 1 percent in Hong Kong to a record low of HK$3.68 (47 US cents).

International Monetary Fund Managing Director Kristalina Georgieva said in Beijing this week that China should allow "zombie firms" in the property sector to fail.

On Friday, Hong Kong's Hang Seng Index rose 1.75 percent but lost 0.42 percent for the week. Japan's Nikkei gained 0.68 percent in the week, while South Korea's Kospi added 1.64 percent.

In New York, major markets fell on Friday, with the tech-heavy Nasdaq posting the biggest decline. It fell 1.7 percent as investors pulled out of technology stocks. For the week, the index was down 1.6 percent and the broader S&P 500 was off 0.6 percent. In Europe, the Stoxx600 lost 0.5 percent on Friday, with Dutch semiconductor maker ASMI dropping 4.9 percent and semiconductor-equipment manufacturer BESI losing 3.5 percent.

In Case You Missed It...