Moore Threads' Dazzling Debut Buoys Chinese Stock Markets

China's stock markets rebounded on Friday after days of lame performance, buoyed by the dazzling debut of chipmaker Moore Threads, often called "China's Nvidia," on Shanghai's STAR Market.

Shares in the Beijing-based graphics processing unit manufacturer surged fivefold from their offer price after an 8-billion-yuan (US$1.1 billion) initial public offering. The debut made Moore Threads the most profitable new stock on Chinese mainland exchanges this year. The company has yet to make a profit, which is no impediment on the Nasdaq-style STAR board, which is dedicated to helping promising technology startups raise funds and promote China's drive for self-reliance in advanced technologies.

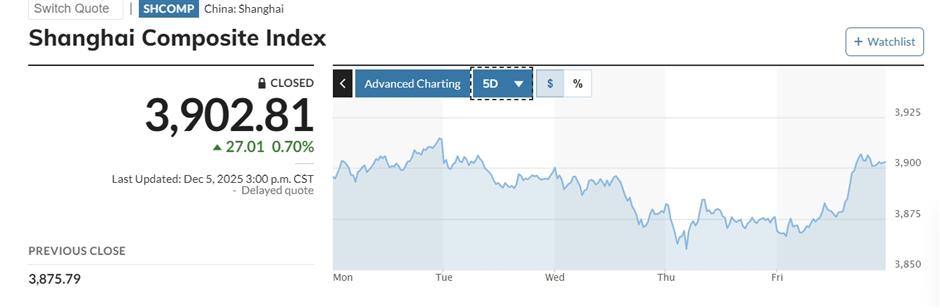

The Shanghai Composite Index rose 0.7 percent on Friday to end the week with a 0.37 percent gain at 3,902 points.

"The tech sector remains the most active sector in China's stock market, and tech shares have become the biggest variables," said Gu Fengda, an analyst with Guosen Securities.

In Shanghai trading, Advanced Miro-Fabrication Equipment shares rose 1.3 percent, and OmniVision Integrated Circuits was up 0.4 percent.

The Shenzhen Component Index also gained 1.08 percent on Friday and 1.26 percent for the week. Hong Kong's Hang Seng Index added 0.87 percent for the week.

On Friday, Wu Qing, chairman of China Securities Regulatory Commission, said in an article published in People's Daily that China will enhance foreign investment in its capital market and improve the efficiency of financing for priority sectors.

"China should beef up efforts on the development of direct financing, especially stock and bond markets, which is key to enhancing the institutional inclusiveness and adaptability of the capital market," Wu said.

Across Asia, Japan's Nikkei lost 1.05 percent on Friday amid bond market jitters but still gained 0.5 percent for the week, while South Korea's Kospi jumped 1.8 percent, ending the week with a 4.4 percent increase.

In New York markets, investor focus turned to the Federal Reserve, which meets next week amid inflation data that could provide the impetus for another rate cut. Traders are pricing in an 87-percent chance of a reduction.

The S&P 500 index rose for a fourth day, closing up 0.2 percent. The tech-heavy Nasdaq ended up 0.3 percent. Bitcoin lost 3 percent, falling below US$90,000. In Europe, the Stoxx600 index closed flat.

In Case You Missed It...

![[Quick News] YES, You Can Bring Your Pets to the Cinemas Now!](https://obj.shine.cn/files/2025/12/04/de999b69-a2e6-4d7a-8be7-be6f1a41ad05_0.jpg)