Bulls or bears? Chinese stock markets turn volatile as investors weigh strength of powerful rally

China's stock markets gyrated this week, with major indices ending down amid concern about lackluster company earnings and speculation that regulators may be considering measures to cool a heated market rally that has increased the value of Chinese mainland bourses by over US$1 trillion.

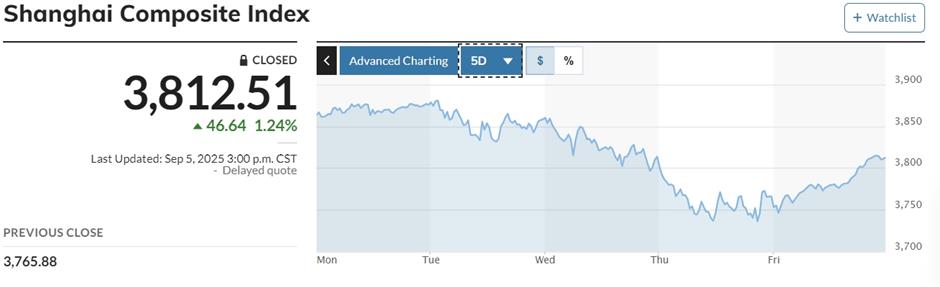

The benchmark Shanghai Composite Index posted a 1.2 percent loss for the week after tumbling more than 1 percent on Wednesday and Thursday, then rebounding 1.24 percent on Friday to remain above 3,800 points.

The Shenzhen Component Index held its weekly decline to 0.83 percent after a 3.9 percent rally on Friday. However, the Growth Enterprise Index, which focuses on tech startups, jumped 6.55 percent on Friday, led by makers of batteries, solar panels and third-generation semiconductors, ending with a weekly gain of 1.5 percent.

"Investors, especially more recent retail entrants in the markets, must have been nervous this week because of the sharp drops," said Yuan Li, an analyst at Soochow Securities. Last week, she had called for caution when investor sentiment turns overly optimistic.

Retail investors comprise about 90 percent of stock market traders in China, and 1,000 new individual investors piled into the markets in July amid reports of people cashing out of bank savings to jump on the bandwagon. The recent surge in the Shanghai market to a 10-year high revived memories of 2015, when stocks skyrocketed at alarming rates, only to collapse just as fast. Regulators may be considering measures such as curbs on short selling and wild speculation.

The debate continues about whether markets are approaching a tipping point. Last month, China Securities Regulatory Commission Chairman Wu Qing pledged to maintain stability and rational investing. Nomura this week said, "The stock boom has the potential to lead to irrational exuberance and the formation of a bubble."

However, others disagree. Richard Tang, China strategist for private Swiss bank Julius Baer told Yicai that "We believe the stock market is far from reaching bubble levels and has room for further growth." And Meng Lei, China equity strategist at UBS Securities, said this week that the market – and especially technology stocks – has yet to show signs of overheating.

"Regarding the liquidity-driven 'bull market' in A-shares, investors have shown an overall increase in interest and a generally optimistic outlook," Meng said, noting recent discussions he had with some Chinese mainland and Hong Kong investors.

The summer rally has been driven by technology companies, with artificial intelligence a hot play. In a sign of market whipsaw, shares in Shanghai-listed AI chipmaker Cambricon, which became the market darling in August after reporting first half revenue surged 4,347 percent and briefly rose to be the mainland's most expensive stock, plunged 18 percent on Wednesday and Thursday, but surged 6.6 percent on Friday.

Hong Kong's Hang Seng Index lost 0.35 percent this week, while Japan's Nikkei advanced 1.55 percent while South Korea's Kospi rose 1.28 percent.

In New York, stocks dropped on Friday after the August jobs report showed a fewer-than-forecast 22,000 new jobs created, sending the unemployment rate up to a four year high and undercutting President Donald Trump's claim of a booming economy. However, only the Dow Jones showed a loss for the week, down 0.3 percent. The S&P 500 rose 0.3 percent, and the Nasdaq added 1.1 percent.

European stocks slipped slightly on Friday, with the broad Stoxx600 down 0.2 percent.

In Case You Missed It...