China stock market rally fueled by Johnny-come-lately individual investors

Chinese mainland stock markets continued a rally this week, amid reports that people are pulling money out of bank and wealth management accounts to invest in shares as markets hit 2025 highs this month. Individual investors comprise 90 percent of the market. Some analysts warn that the markets may be nearing a tipping point.

"People need to be cautious when optimism starts spreading like wild fire," said Yuan Li, an analyst at Soochow Securities. "Some big-cap firms missed estimates in half-year earnings, and global trade disputes have no certain answers in near sight."

Among companies reporting lower earnings or even losses this week were: technology companies Huawei and ZTE, major banks, property developers, consumer-goods retailers Meituan and PDD, oil producers, and carmakers BYD and Li Auto.

Brokerages, however, benefited from the influx of investment. Citic Securities, the largest mainland brokerages, reported a 30 percent rise in half-year revenue. And e-commerce giant Alibaba posted a 78 percent in its first-quarter profit, though it didn't join Meituan in disclosing the adverse impact of the fierce competition in the fast-delivery food market.

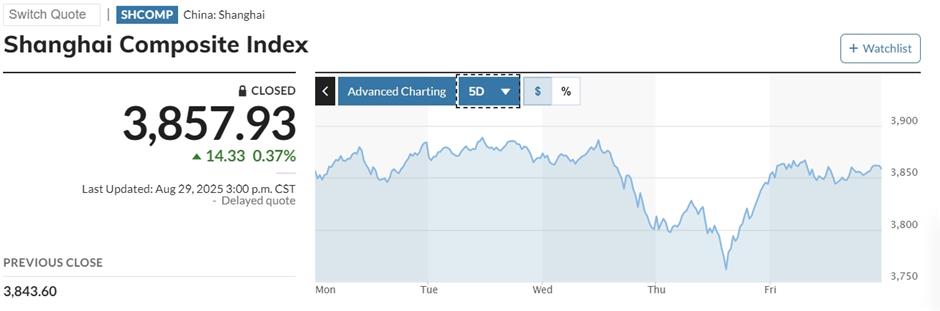

China's benchmark Shanghai Composite Index rose 0.84 percent for the week and 6.9 percent for the month of August to end at 3,857. The smaller Shenzhen Component Index advanced 4.4 percent this week and 15 percent in the month to close at 12,696. The Growth Enterprise Index posted a weekly surge of 7.7 percent and a monthly surge of 24 percent, ending on Friday at a three-year high of 2,933.

"People are much encouraged by the recent performance of Chinese stock market, and we are happy to see the indices at a relatively high level for another week," said Yuan. "The market is bolstered mainly by the tech sector, which has sustained its growth since the start of the year, and is expected to continue its strength."

The stellar performer this week was Shanghai-listed Cambricon Technology, a leading Chinese AI chipmaker, whose market price surged to more than 1,600 yuan (US$224) a share after the company reported a 43-fold increase in first half profit to 2.9 billion yuan, surpassing premium liquor maker Kweichow Moutai as the most expensive Class A share.

Surging gold prices boosted China's Zijin Mining, a major producer of gold, copper and zinc, which posted record first-half net profit of 23.3 billion yuan, up 54 percent from a year earlier. But it also warned that intensifying global competition for critical minerals and rising nationalism enveloping natural resources could challenge overseas projects.

The Hong Kong market posted a 1.03 percent decline for the week as investors took some profits from a strong month of price gains. Elsewhere in Asia, Japan's Nikkei lost 0.6 percent this week, and South Korea's Kospi slipped 0.15 percent.

In New York, the Dow Jones Average posted a 3 percent gain for the month of August. The S&P 500 advanced by 2 percent, and the Nasdaq added 1.6 percent in the month.

In Case You Missed It...