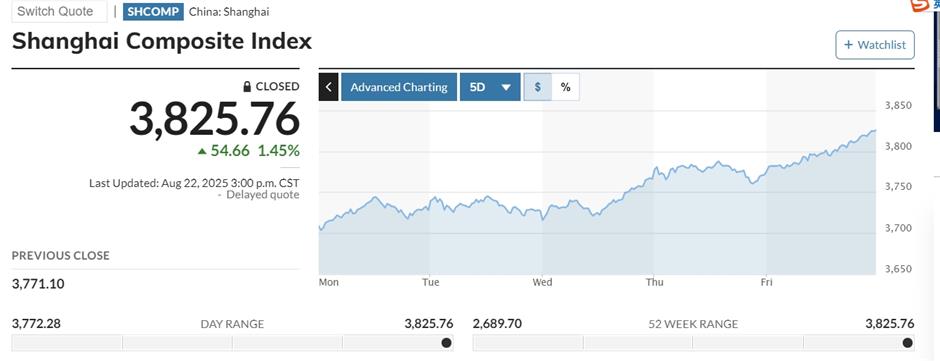

Company earnings and tech frenzy propel Shanghai stock market to 10-year high

Chinese equities surged on Friday, with the Shanghai Composite ending at its highest level in a decade, driven largely by strong corporate earnings and continuing investor appetite for semiconductor and AI stocks.

For the week, the Shanghai Composite Index rose 3.1 percent, with the Shenzhen Component Index up 4.6 percent and the Growth Enterprise Index adding 5.9 percent.

Market volume in Shanghai and Shenzhen exceeded 2 trillion yuan (US$279 billion) for the eighth straight day, breaking records.

Nearly 2,800 stocks posted gains. Shares in Cambricon Technology, a leading Chinese AI chipmaker, surged 20 percent on Friday to 1,243 yuan, taking market value above 500 billion yuan.

On Thursday, Chinese artificial intelligence startup DeepSeek released its V3.1 upgraded model with hybrid inference structure, faster thinking speed and stronger agent capability. The firm said it's designed to work with upcoming China-developed AI chips.

"It is a celebration of the continued development of DeepSeek, and that affects the whole industry," Orient Securities wrote in a research note.

Beyond the AI and chip sectors, nearly 600 of the 1,000 listed companies releasing half-year earnings this week showed positive growth, with more than 100 doubling profits.

"The recent performance of China's stock markets is a reflection of strengthened investor confidence, which is broad-based and solid," said Huang Wentao, an economist at Citic Securities.

According to the Shanghai Stock Exchange, investors opened almost 2 million new Class A share accounts in July, up 71 percent from a year earlier. Most of the new accounts are held by individual investors.

Elsewhere in Asia, Japan's Nikkei lost 1.9 percent this week, and South Korea's Kospi fell 1 percent.

In New York, stocks surged on Friday following several days of declines, after Federal Reserve chair Jerome Powell indicated the central bank may be poised to lower interest rates. For the week, the Dow average rose 1.5 percent, the S&P was up 0.3 percent.

The Nasdaq, however, slipped 0.6 percent on investor uncertainty about technology stocks.

European stocks were moderately higher on Friday, with the pan-European Stoxx 600 index up 0.5 percent and London's FTSE100 hitting a record high.

In Case You Missed It...

![[Expats & Ailments] US Professor Finds Cure in Shanghai After 6 American Surgeries](https://obj.shine.cn/files/2025/12/12/b894378d-4551-4662-b411-368a45770a34_0.jpg)

![[Expats & Ailments] Malaysian Children Thank Shanghai Doctors for Saving Their Lives](https://obj.shine.cn/files/2025/12/13/e9a200be-df6b-44e6-87ef-581c0943bb08_0.jpg)