Chinese Stock Markets Retreat on Tightening Regulatory Controls

China's stock markets pulled back this week as regulators unveiled measures to contain margin and "flash" trading to keep rallies from spinning out of control.

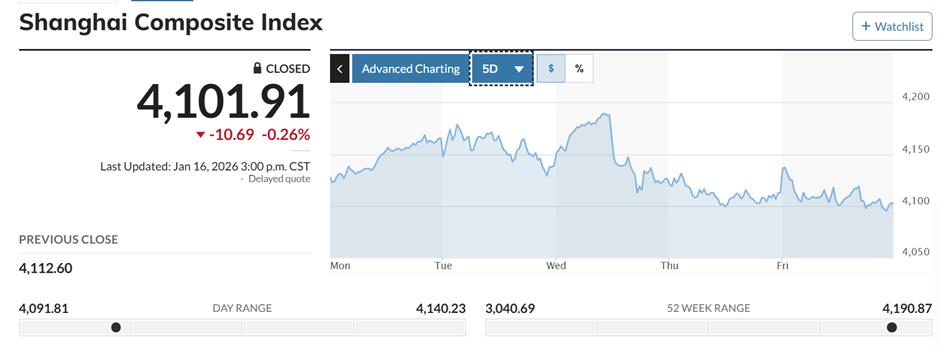

The benchmark Shanghai Composite Index lost 0.45 percent in the past five trading days, ending the week at 4,101 points. The Shenzhen Component Index declined 0.6 percent during the week, while tech-focused board ChiNext slid 0.81 percent.

The correction started on Tuesday after a 17-day rally. The retreat deepened on Wednesday when China's stock exchanges raised the minimum ratio for securities bought on margin to 100 percent from 80 percent, requiring investors who buy shares with borrowed money to dig deeper into their own pockets. That was followed by new rules limiting use of complex computer algorithm programs that execute "flash" trades in split seconds.

"The markets need a break to allow investors to calm down a bit," said Zhang Yu, an economist with Hua Chuang Securities. "Especially in some overheated sectors, supervision should be strengthened to keep markets rational."

However, Meng Lei, a China equities strategist at UBS Securities, said it's too early to call Chinese investors overactive and he expects China's stock markets to continue strong growth momentum in 2026 despite the current corrections.

"We forecast that foreign investors will keep lifting their ownership of Class A shares, especially in tech-related sectors," Meng said.

China's commercial rocket sector was among industries where more cautious investment was advised. Companies including China Aerospace Times Electronics Technology, CICT Mobile Communication Technology and Leiki Defense Technology issued statements warning that a strong rally in sector share prices was running ahead of industry prospects.

Following the warnings, Huanyu Communication Technology shares fell 18.3 percent on Wednesday, and Goldwind Science & Technology declined 3.4 percent.

One bright spot in Friday trading was the surge in electricity-related companies after State Grid announced plans to invest 4 trillion yuan (US$574 billion) over the next five years to upgrade the nation's power network, amid surging electricity demand from artificial intelligence data centers. Transformer maker Tianwei Baobian Electric rose 2.9 percent and power equipment manufacturer Pinggao Electric surged 4 percent.

Outside the Chinese mainland, Hong Kong's Hang Seng Index rose 2.3 percent for the week, Japan's Nikkei jumped 3.9 percent on expectations of a snap parliamentary election next month, and South Korea's Kospi climbed 4.7 percent on strong signs in its chip-making industry.

In New York, the S&P 500 posted a 0.4 percent drop for the week, while the tech-heavy Nasdaq lost 0.7 percent. Solid investment bank earnings were offset by investor concerns about the Trump administration's federal criminal probe of Federal Reserve Chairman Jerome Powell and by a threat from President Donald Trump to impose "stiff" tariffs on nations that opposed his plans to takeover Greenland. Tensions over the Greenland issue send the Stoxx600 index in Europe down 0.03 percent.

In Case You Missed It...