Finance Shares Lag Tech Heyday, But Investors Reward Innovative Firms

Editor's note:

This series explores the "winners" and "losers" of listed Chinese companies in terms of share prices in 2025, the reasons behind and possible winners in 2026.

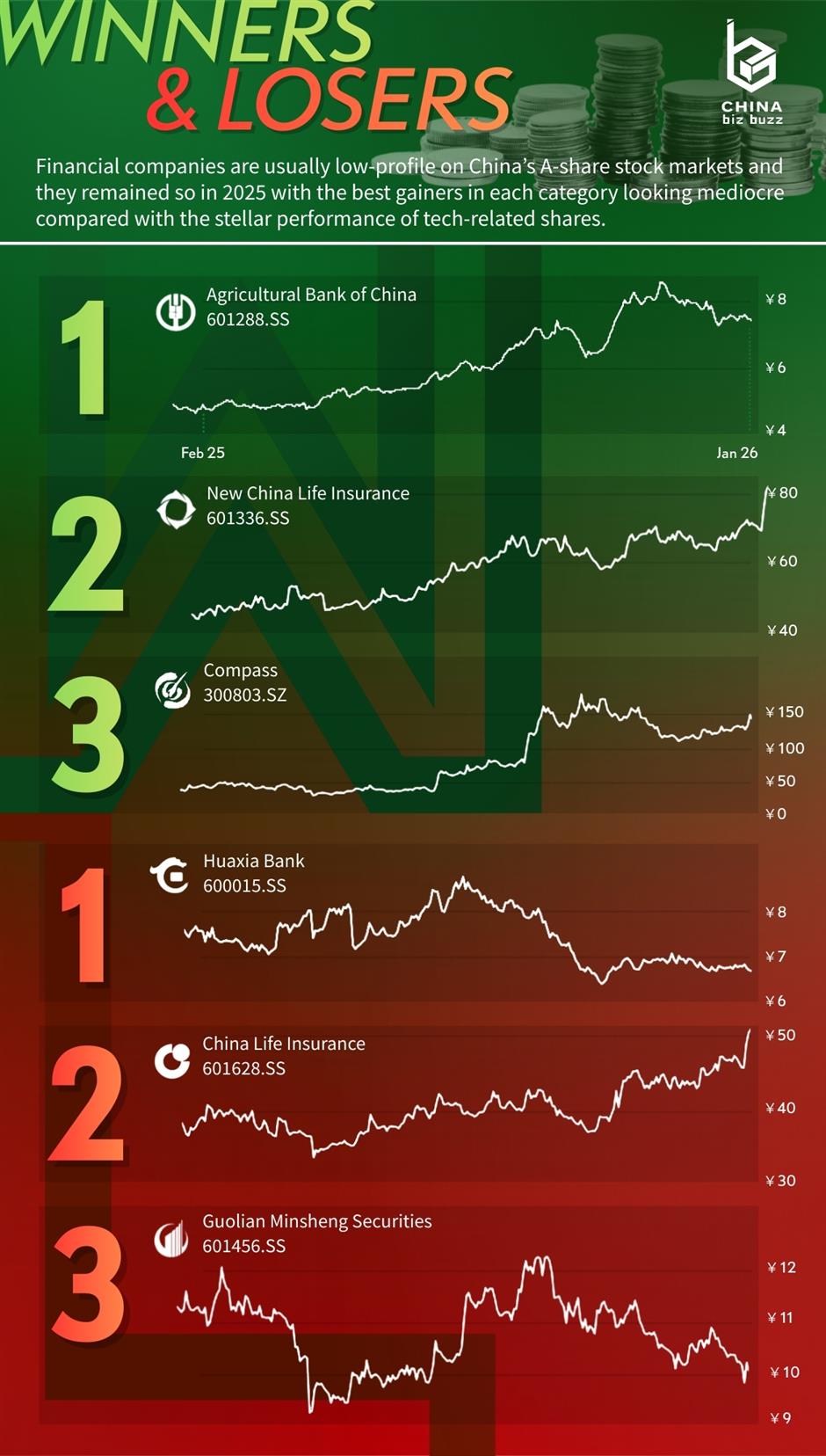

Banks, insurers and other finance companies took a backseat to the surge in technology shares on Chinese mainland markets in 2025, but in a sense, it's their traditional stability that attracts more risk-averse investors.

"Financial companies need to be stable," pointed out Ni Jun, an analyst with GF Securities. "Too sharp ups or downs aren't good for business or markets."

The SWS Banking Index, compiled by Shenwan Hongyuan Securities, rose 6.9 percent in 2025, while its insurance index jumped 28 percent.

Analysts said banks may see a bit more volatility this year as they continue to struggle with low net interest margins. Lenders are shifting toward income growth from invested capital and away from dependence on interest-rate income.

"Banks that have better risk control and lower interest rate sensitivity may stand out," Ni said.

The insurance industry in China has made rapid gains in the past 20 years as national economic reforms pared back the government umbrella that formerly covered life's risks. Lin Jiali, an analyst with Sealand Securities, predicts that the insurance sector will continue a strong performance in 2026, especially among companies that seize opportunities related to China's aging population.

We take a look at the winners and laggards in finance for 2025.

Top performers: innovation and targeted business

Agricultural Bank of China (stock ticker: 601288.SS)

The Agricultural Bank of China, which once didn't enjoy a high profile because of its rural roots, has ridden the wave of China's pro-farm policies, expanded its lending scope and emerged as the world's second-largest bank by assets. Its share price last year jumped 53 percent, the top performer of the "big four" state-owned banks.

By contrast, Industrial and Commercial Bank of China, the world's largest bank, rose 21.5 percent; China Construction Bank increased 12.9 percent and Bank of China gained 10.8 percent. Their relatively stable performance paled by contrast with Shanghai-listed Swancor Advanced Materials, which led Chinese mainland markets with a 1,820 percent surge in its share price for the year.

The Agricultural Bank of China has developed its network deeper into town-level communities that have prospered under national agricultural reform. It has also invested heavily in financial technology and hired more tech-oriented professionals to provide more experienced services to technology companies.

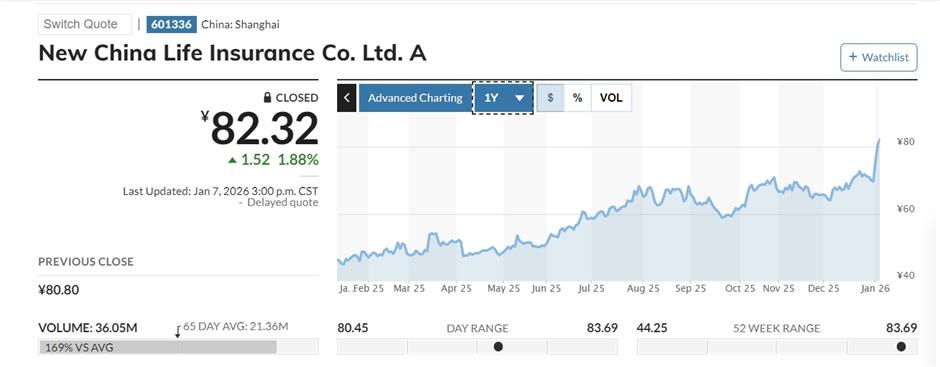

New China Life Insurance (601336.SS)

Strong income growth led New China Life Insurance to top performer on Chinese mainland markets last year, with its shares rising 40 percent. It was followed by Ping An Insurance, which rose 36 percent; China Pacific Insurance, up 27 percent; and People's Insurance Co, which gained 21 percent.

"The insurance sector is more aggressive compared with banks, and in 2025, people tended to develop a higher awareness of safety, which assisted the sector to get more new business and supported their stock performance," said Sealand Securities' Lin.

Beijing Compass Technology Development (300803.SZ)

Shenzhen-listed Beijing Compass Technology Development Co Ltd was the best performing financial services firm in 2025, with an 89 percent surge in its share price.

The Beijing-based company develops and provides securities analysis software and securities information solutions, offering financial data analysis and securities investment consulting services. Its customer base and fee income were enhanced by its acquisition of Maigao Securities.

Worst performers: lack of innovation, scaling up problems

Huaxia Bank (600015.SS)

Beijing-based Huaxia Bank lost 9.8 percent of its share price in 2025, the worst performer in the banking sector. Its income contracted 8.8 percent in the first three quarters of 2025, partly due to its slow upgrade in financial technology. Government-related business remained its principal source of income.

China Life Insurance (601628.SS)

China Life Insurance was the worst performer in its industry on Chinese mainland markets, with a share price gain of only 8.5 percent, lagging the18.4 percent increase in the Shanghai Composite Index.

Analysts said the insurer has been slow to transition into services catering to China's ageing population, compared with rivals like Ping An Insurance.

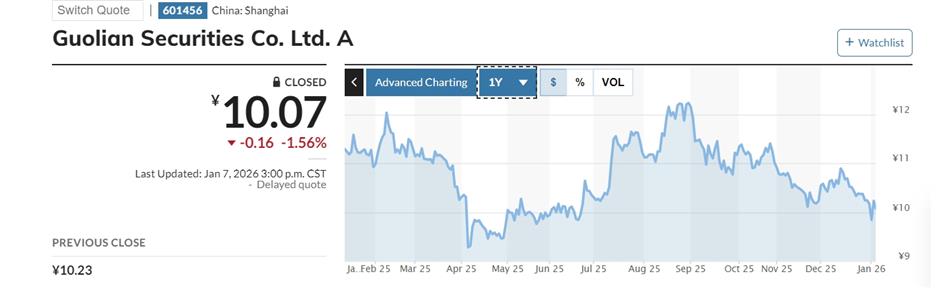

Guolian Minsheng Securities (601456.SS)

Wuxi-based Guolian Minsheng Securities suffered a 22.5 percent decline in its share price in 2025 after the merger of Guolian Securities and Minsheng Securities in a 29.5 billion yuan (US$4 billion) deal was completed at the start of the year. Analysts suggested teething problems combining the operations of both firms.

In Case You Missed It...