Technology Bulls Hoist Shanghai Stock Market to a Decade High

The bulls were running this week as buying continued a late 2025 rally and pushed the Shanghai Stock Exchange to a decade-high record. Enthusiasm for technology shares was fanned by a recent string of strong market debuts in Hong Kong by Chinese mainland companies in artificial intelligence sectors.

On Friday, shares in Shanghai-based AI company MiniMax doubled from their offer price on their first day of trading after a HK$4.8 billion (US$610 million), heavily oversubscribed initial public offering. That followed by a day strong debuts from Zhipu AI, Iluvatar CoreX Semiconductor and surgical robot-maker Edge Medical.

"The successful IPOs of these startups have fanned the expectations of Chinese investors," said Lian Ping, a council member of the China Chief Economist Forum and head of the Guangkai Chief Industry Research Institute.

"Confidence is driven by the belief that China is firmly embedded in the technological revolution and has secured an important position in key sectors," he said.

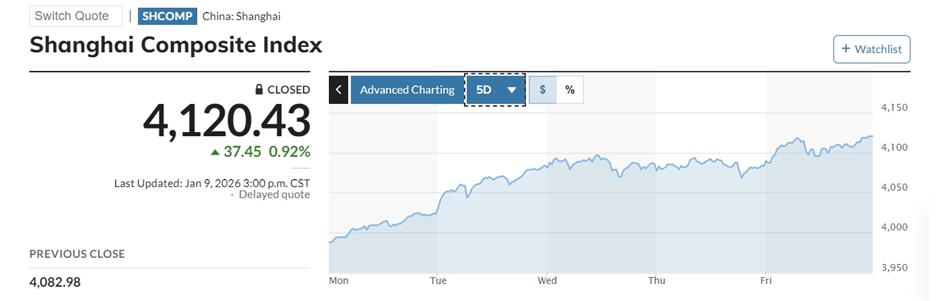

The benchmark Shanghai Composite Index on Friday rose for the 16th straight day, ending the week up 3.8 percent at 4,120 points. The Shenzhen Component Index jumped 4.4 percent for the week, while the tech-heavy ChiNext gained 3.9 percent.

Combined volume on Shanghai and Shenzhen exchanges hit 3.1 trillion yuan (US$440 billion), the second-highest level on record.

However, some analysts continue to warn of risks in the global AI investment frenzy.

The Standard Chartered Global Market Outlook for 2026 flagged caution about possible "negative shock or disappointment relative to high expectations in AI."

"Managing emotions is key to investing," said Steve Brice, global chief investment officer of Standard Chartered. "Scenario planning will help prepare investors for the volatility expected in the coming year."

He acknowledged "bubbles blowing in the equity market led by the boom in AI," but said the situation is different from the 1990s dot-com bubble that burst.

Global investors this week generally shrugged off geopolitical tensions related to the US attack on Venezuela, Iranian mass protests and Washington's threats to take over Greenland. Hong Kong's Hang Seng Index closed up 0.3 percent on Friday but slipped 0.4 percent for the week on some profit-taking. Japan's Nikkei rose 3.2 percent for the week, and South Korea's Kospi surged 6.4 percent.

Technology-led rallies sent markets in New York and Europe higher. The S&P 500 rose to a record after chalking up a weekly gain of 1 percent, while the tech-heavy Nasdaq jumped 2.3 percent in the week. The Stoxx600 index in Europe added 1 percent on Friday.

In Case You Missed It...

![[SH Buzz] 8 New Restaurants & Green & Safe CLOSING End of Month](https://obj.shine.cn/files/2026/02/25/0b1f15ad-bb94-4d79-a064-c06c1c272c62_0.jpg)