Yuan's Rise, Aerospace and Other Industry News Lift China Stocks

Chinese stock markets rose on Friday as the yuan traded at its highest level in more than a year against the US dollar, fueling investor optimism that the central bank may tolerate gradual appreciation of the currency to bolster confidence.

The yuan was trading offshore above the exchange rate of 7 to the US dollar for the first time in 15 months, while share gains were also supported by positive corporate news.

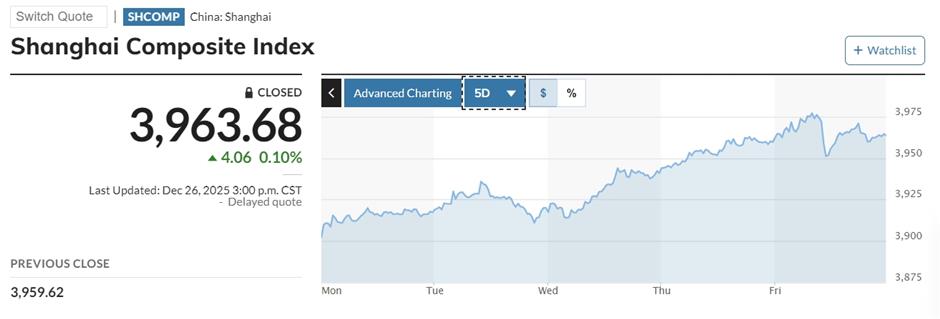

The benchmark Shanghai Composite Index rose 0.1 percent on Friday to end the week up 1.9 percent at 3,963. The Shenzhen Component Index posted a weekly gain of 3.5 percent, while tech-focused ChiNext jumped 3.9 percent.

"The recent bullish performance implies a cross-year rally, when institutional investors review and sometimes shuffle their portfolios," said Liu Chengxiang, an analyst with Kaiyuan Securities. "Individual investors can ride the wave."

In the corporate realm, Fenglong Electric shares rose 10 percent after UBTech Robotics said it will seek to take control of the Shenzhen-listed company in a 1.7-billion-yuan (US$237 million) deal. Contemporary Amperex Technology (CATL) rose 0.4 percent after announcing a partnership with Guoxin Microelectronics to form a new automotive semiconductor company. Shares in Longi Green Energy and TCL Zhonghuan, both rose after the companies said they are hiking prices by 12 percent amid surging AI-related demand for chips.

Jiangxi Copper shares gained 0.7 percent after China's largest integrated copper producer said it will acquire the 88 percent of Ecuadorean miner SolGold that it doesn't already own for US$1.1 billion. IFlytek stock was up 0.2 percent after announcing it is setting up a new company to expand into semiconductors and other AI-related fields.

Liu predicted shares of food, consumer goods and gold will fare well in early January as the Chinese Lunar New Year approaches in February – a traditional time of more spending. He also said high-tech sectors, including artificial intelligence, semiconductors, commercial aerospace and humanoid robots look set to add to 2025 gains.

In a major development, the Shanghai Stock Exchange said Chinese companies developing reusable commercial rockets will get a fast track to initial public offerings on the tech-heavy STAR Market, a move seen to benefit Chinese private rocket developer LandSpace, which recently became the first domestic company to carry out a full reusable rocket test, though it failed to recover the booster rocket. The company is preparing for a listing on the STAR Market, which hosts promising technology startups and has risen 48 percent this year.

"Although China did not succeed in the attempt to recover a reusable rocket, investors have spotted the huge potential of commercial aerospace and strong central government support for the sector," said Liu Zejing, an analyst with Huaxi Securities.

Elsewhere in the aerospace industry, shares in Guanglian Aviation surged 12 percent on Friday and Jovo Energy shares shot up 2.5 percent after the liquefied natural gas wholesaler said it plans to spend 300 million yuan to expand production of commercial aerospace fuel.

For the week, Hong Kong's Hang Seng Index ended 1.4 percent higher before closing on Thursday and Friday for the Christmas holidays. Japan's Nikkei gained 2.5 percent and South Korea's Kospi added 3.4 percent.

In New York, the three major indexes closed flat on Friday but managed weekly gains in holiday-abbreviated trading. The S&P 500 gained 1.4 percent, while the Dow and Nasdaq were up 1 percent.

Gold, silver and platinum rose to records on Friday, capping a week of gains related to a weak US dollar, geopolitical concerns and expectations of further US rate cuts.

In Case You Missed It...