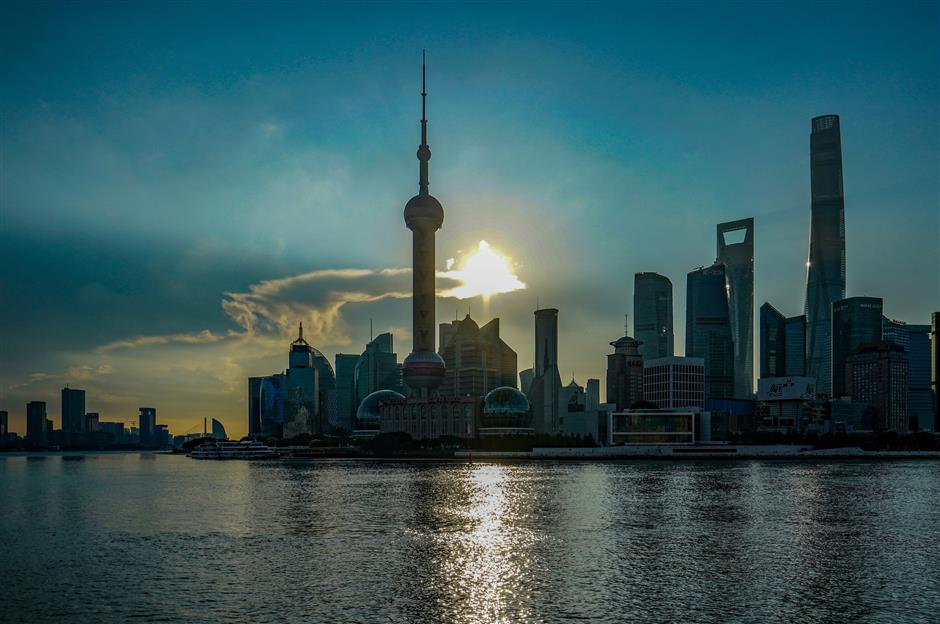

New projects galore as Lujiazui sees spike in foreign investment

Foreign investment in Shanghai's Lujiazui financial district accelerated this year, with agreements on 156 new projects signed from January to July and contracted capital rising 14 percent to US$923 million. Actual inflows reached US$633 million in the same period, up 44 percent from a year earlier, according to local officials.

The figures underscore Lujiazui's role as China's most internationalized central business district. Though occupying just 0.5 percent of Shanghai's land, the CBD in the Pudong New Area generates nearly 14 percent of the city's GDP. The concentration of global institutions is striking: 70 percent of foreign asset managers in China are based here, along with 40 percent of foreign banks and brokerages and more than half of wholly foreign-owned mutual fund firms.

"Financial services already make up nearly 60 percent of Lujiazui's GDP, and foreign institutions are continuing to expand," said Zhou Haidong, deputy director of the Lujiazui administration bureau. "We aim to further push the opening up in banking, securities, funds, futures and insurance, while attracting more global players to establish operations here."

For multinationals, the appeal is both financial access and the ability to experiment with innovation.

French software maker Dassault Systèmes, which has expanded its China business more than 20-fold in the past two decades, reported double-digit growth in the first half of 2025. In July, it launched the 3DEXPERIENCE Lab, an innovation hub aimed at connecting Chinese manufacturers with advanced 3D design and simulation tools.

"Shanghai offers a world-class business environment," said Suo Ailun, who oversees new business for Dassault in China.

British accounting firm Ernst & Young has positioned its Wavespace in Lujiazui as an innovation hub, using emerging technologies to support its own growth and provide services to clients. The space brings together disruptive tech, business strategy and digital transformation, serving as a platform where companies can test new ideas and apply them to operations.

"Shanghai is not only home to a large number of foreign headquarters but also to many Chinese Fortune 500 companies in industries from pharmaceuticals and steel to autos and the internet," He Zhengyi, EY Wavespace workshop designer, noted.

"That diversity allows us to tailor our services for both domestic and international clients, including guidance on China's ongoing opening up policies as well as developments in technology and the financial ecosystem."

Other firms highlight the need to adapt global playbooks.

"Chinese clients demand speed and shorter project cycles – you can't simply copy global templates," said Yosuke Nakano, regional head of ABeam Consulting. The Tokyo-based consultancy has reshaped its services to match local expectations, focusing on compressed delivery times and bespoke solutions.

Legal services are also in demand as Chinese companies expand abroad.

"Lujiazui is not only Shanghai's financial center but a world-class hub. The international, rules-based and efficient business environment here, along with pragmatic government support for market innovation, has provided strong assurance for our operations and growth," said Shi Miao, senior partner at Baker McKenzie FenXun.

The law firm combines Baker McKenzie's international network with local expertise, and recently joined a Pudong service platform aimed at helping Chinese firms manage cross-border compliance. "Everything we do is closely tied to China's policy of expanding and deepening its openness," she added.

In Case You Missed It...