Foreign Luxury Carmakers Slash Prices in China As Sales Traction Slips

Germany-based BMW kicked off this year with big discounts as high as 300,000 yuan (US$41,640) in the China market. This unprecedented level of price reduction covers a range from entry-level to flagship models. Specifically, 24 models have had price cuts of over 10 percent, with five models dropping by more than 20 percent.

Among these, the BMW iX1 eDrive25L saw the largest percentage decrease at 24 percent. The i7 eDrive50L Exclusive Edition also saw a significant reduction, with its price falling below 1 million yuan for the first time.

But the biggest visible drop on window sticker prices came on BMW's pure electric flagship, the i7 M70L. Its price was slashed by more than 300,000 yuan, declining to just over 1.6 million yuan.

BMW is not the only luxury auto brand struggling to regain traction in the competitive China car market.

Earlier, Maserati unveiled discounts of up to 60 percent on some of its models, specifically the Grecale series, where starting prices were ranging from 650,800 yuan to 898,800 yuan.

Meanwhile, the Aston Martin Vantage Roadster, which launched a year ago with a price tag of 2.3 million yuan, has undergone a reduction of 450,000 yuan just seven months after its release. Similarly, the new Vantage Coupe hardtop version also received a 450,000 yuan discount, with its price shifting from 2.2 million yuan to 1.8 million yuan.

Fueling all these discounts are grim sales figures for foreign luxury carmakers in China.

In the first nine months of last year, Italy's Ferrari car shipments to the mainland, Hong Kong and Taiwan tumbled 13 percent drop from a year earlier ─ the only global region of the carmaker to decline.

Britain's Rolls-Royce reported sales in China in 2024 nearly halved from their peak in 2021 to 812 units vehicles. And deliveries in the first five months of this year totaled only 289 units, suggesting another annual halving.

German carmaker Porsche said China accounted for its largest-ever drop in global sales from the first quarter to the third of last year, with a year-on-year decline of 26 percent.

Last month, Porsche's largest authorized dealership in central China's Henan Province, owned by Dongan Holding Group, abruptly shut down, with customers claiming problems related to vehicle and maintenance-package deposits. Porsche China apologized and said it is investigating the matter.

For the first nine months of the year, the China Passenger Car Association, said the market share of premium foreign cars in China fell to 13 percent, down from a peak of 15 percent in 2023.

What's going on?

Some blame slowing consumer demand and tighter spending power. The Associated Press recently published an article headlined: "High-End Car Sales Sink in China as Its Economy Slows, Taking a Toll on European Automakers." It said "customers opt for more affordable Chinese brands, often sold at big discounts, catering to their taste for fancy electronics and comfort."

However, the article is misleading. It's not a matter of domestic brands being "cheap" or offering steep discounts. Rather, it's a case of Chinese consumers redefining "luxury." It's no longer about the rev of a V12 engine or hand-stitched leather interiors; it's about smart driving features.

One only has to look at the "Huawei effect." Huawei's Maextro S800, priced at roughly 708,000 yuan, is currently outselling its equivalent Porsche and Mercedes rivals. Why? Because it offers a level of driver-assisted features and "third-space" digital integration that the Europeans haven't mastered yet.

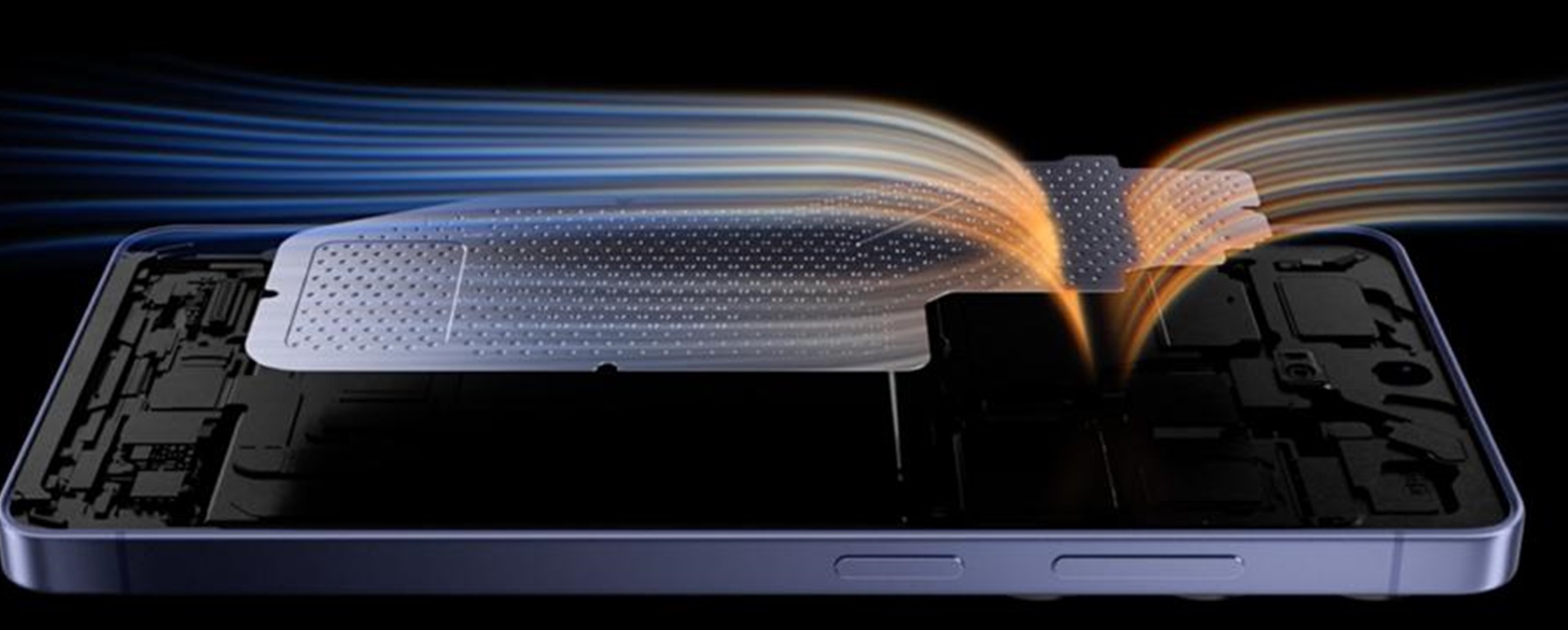

Huawei incorporates its HarmonyOS ALPS Cockpit 2.0 and ADS 4.0 to create a seamless environment that transforms the model from a mere vehicle into a "second living room" or a mobile executive office.

Cumulative deliveries of Huawei's Maextro S800 model surpassed 10,000 units last week, setting a record for Chinese ultra-luxury, new-energy sedans just 202 days after its market launch.

Even the traditional Chinese luxury brand, Hongqi has shaken off the dust of its former glory to adapt to the contemporary market. Its sales surged 9.2 percent this year, with their new-energy sub-brands growing by 61 percent.

Hongqi moved away from generic software and launched its proprietary JiuZhang Intelligent System, which manages everything from the cockpit to the chassis.

In electric cars, the Xiaomo SU7 Ultra has been outselling the Porsche Taycan Turbo GT, largely because of its advanced functional performance.

It's fair to say that younger, tech-savvy Chinese consumers increasing view the traditional big motoring names as "legacy" rather than "cutting-edge."

But the market isn't centered only on younger consumers. The consumer profile of Huawei's Maextro S800 shows buyers who previously owned luxury brands such as Rolls-Royce, Maybach and Porsche. The customer base is 80 percent male, with ages largely concentrated between 40 and 50. Notably, half of those customers are purchasing the S800 as an additional vehicle, while 30 percent are trading in their current cars.

The Chinese government's trade-in subsidy program ─ capped at 40,000 yuan for new-energy vehicles costing 300,000 yuan or more ─ has played a role in the downfall of foreign luxury brands, but with the government's separate tax incentive on purchase of electric and hybrid cars halving at the beginning of this year, the picture becomes more complicated.

By late 2025, new-energy vehicles accounted for 52 percent of all passenger vehicle sales in China, the first time they have surpassed internal combustion models. For domestic brands that embrace new technologies there will be a path forward; for carmakers that rely only on once venerated brands, the Chinese market is looking like a very cold place indeed.

In Case You Missed It...