Shifts in Chinese Pharma Industry Influence Bets by Stock-Pickers

Editor's note:

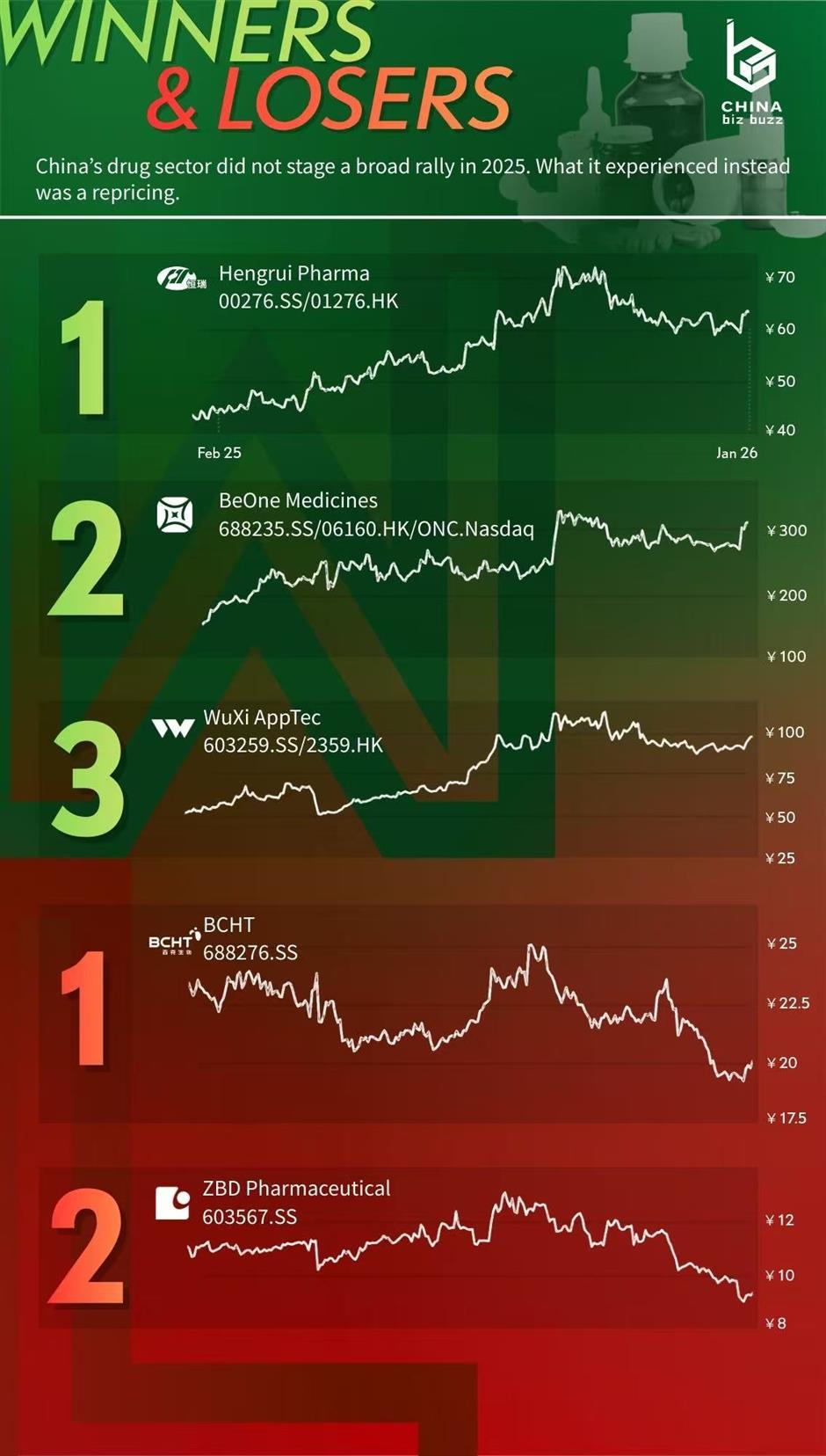

This series explores the "winners" and "losers" of listed Chinese companies in terms of share prices in 2025, the reasons behind and possible winners in 2026.

China's pharmaceutical stocks didn't stage a broad rally in 2025. Rather, they underwent selective repricing as government policies aimed to transform the healthcare system and go beyond the nation's reputation as a mere copycat-drug producer.

Investment favored companies that could show real progress in commercializing innovative drugs, securing overseas licensing deals or building international sales networks.

Drugmakers whose revenue was tied to domestic hospital procurement, the price-controlled government reimbursement system and volume-driven growth largely failed to attract new money. Against that backdrop, a handful of companies emerged as clear market favorites, while others were quietly pushed to the sidelines.

Top 3 winners

Hengrui Pharma (stock tickers 600276.SS/01276.HK)

Hengrui Pharma shares were one of the strongest performers in China's healthcare sector last year as investors reassessed a company shifting from generic drug manufacture to new drug research. The shares closed 2025 at 59.57 yuan (US$8.50), up 36 percent from a year earlier.

In the first half of the year, the Jiangsu Province-based company reported that sales and licensing income from innovative drugs reached 9.56 billion yuan, accounting for about 60 percent of overall revenue.

The shift from copycat-drug production to therapy development led to several sizeable licensing deals. Hengrui received more than US$200 million in upfront payments from Merck Sharp & Dohme, followed by a strategic partnership with GlaxoSmithKline that covers up to 12 innovative drugs, and includes an upfront payment of US$500 million and potential milestone payments of up to US$12 billion.

The company also expanded its domestic drug pipeline. In the first three quarters, six new Class 1 innovative drugs were approved in China, while 13 additional marketing applications were filed. More than 100 proprietary candidates remain in clinical development.

Looking ahead to 2026, investors will be watching if these trends continue and foreign milestone payment timelines are achieved. New metabolic disease candidates, including Hengrui's injectable dual GLP-1/GIP receptor agonist targeting obesity, have emerged as potential new growth drivers.

BeOne Medicines (688235.SS/06160.HK/ONC.Nasdaq)

BeOne, formerly called BeiGene, had a nearly 70 percent surge in 2025 as the company based in Beijing and the US crossed into sustained profitability after years of heavy research spending.

Its growth has been driven mainly by Brukinsa, a blood cancer drug that treats chronic lymphocytic leukemia. Sales of the drug have continued to expand in overseas markets, particularly in the US, where it has been taking market share from older rival treatments.

Brukinsa is estimated to have generated more than US$3 billion in global sales in 2025, accounting for the bulk of BeOne's product revenue. The drug is now approved for use in 75 global markets, and the company's immunotherapy drug Tevimbra has been approved in 47.

Investors are now assessing whether a new wave of cancer drug therapies, including a next-generation leukemia drug and a new class of cancer therapies, will sustain the BeOne's global growth this year.

WuXi AppTec (603259.SS/2359.HK)

WuXi AppTec staged a rebound in 2025 as earnings momentum returned and geopolitical pressures faded. Its shares rose nearly 70 percent last year, climbing from 53.69 yuan (US$7.67) at the start of the year to 90.64 yuan by December 31.

The Shanghai-based contract drug research and manufacturing group raised its full-year revenue guidance twice during 2025, projecting annual revenue of up to 44 billion yuan after third-quarter results exceeded expectations.

Growth was led by its TIDES platform, which focuses on oligonucleotide and peptide drugs used in fast-growing areas such as GLP-1 weight-loss therapies. Revenue from the segment jumped 121 percent in the first three quarters, making it the company's fastest-growing unit.

WuXi's integrated model covering contract research, development and manufacturing has helped lock in long-term clients and cushion the company through industry cycles. Revenue from US clients rose 32 percent in the first three quarters, underscoring its entrenched role in global drug supply chains.

With an order backlog approaching 60 billion yuan, investors are watching to see if the TIDES platform will continue to anchor growth this year, amid continuing geopolitical and competitive pressures.

Top 2 losers

BCHT Biotech (688276.SS)

BCHT Biotechnology's shares fell 24.3 percent in 2025, as sales of its flagship shingles vaccine failed to meet market expectations.

The Changchun-based company had counted on the domestically developed injection, viewed as a key new profit engine when it was launched in 2023, to drive earnings growth.

Instead, weak demand triggered large-scale product returns and sharp price cuts during the year. More than 200 million yuan (US$29 million) in previously booked revenue was reversed as doses went unsold before expiration.

Price competition intensified as BCHT rolled out discount campaigns to boost uptake, with transaction prices in some regions dropping to a fraction of list levels. At the same time, its core chickenpox vaccine business came under pressure from falling birth rates and rising competition.

With revenue shrinking and operating costs rising, investors will be assessing whether the company can stabilize its inventory, rebuild market confidence and push new vaccine candidates through development.

ZBD Pharmaceutical (603567.SS)

Traditional Chinese medicine maker ZBD's shares fell about 22 percent in 2025, as earnings came under pressure from delays in China's centralized procurement program for the TCM sector in the first half of the year.

Several of its flagship injectable traditional products secured bids under the national bulk-buying scheme, but delays in contract execution in major provinces meant that expected volume gains were slow to materialize, while price reductions compressed margins.

At the same time, Heilongjiang-based ZBD has been trying to reinvent itself. It has been investing heavily in what it calls a "modern TCM + innovative drugs" strategy, including a new herbal medicine for stomach disorders that has entered mid-stage clinical trials. But such projects take years to commercialize and are unlikely to generate profit in the near term.

Several expansion projects, such as new production bases and herbal processing facilities, have also been postponed, delaying any quick boost from new capacity. As sales of its legacy products slid, the cost of these long-term bets further weighed on short-term earnings.

For investors, the question now is whether ZBD can make the most of the procurement contracts it has already won, and whether its experimental pipeline can eventually produce new products that are worth paying for.

Even long-established players in China's pharma sector are feeling the pinch of government initiatives in 2025 aimed at cost controls and incentives to reshape the healthcare industry.

In Case You Missed It...

![[New Eats] Le Zink Is What A Wine Bar Should Be](https://obj.shine.cn/files/2026/03/03/f2ee3189-ce06-468e-96f5-6fbdfdb711b9_0.jpg)