China Ends Year of Strength, Resilience and Global Influence

When the Chinese AI startup DeepSeek surprised the world just a week after US President Donald Trump took office in January, few people really grasped the magnitude of China's emergence at the forefront of cutting-edge science and technology. The past 12 months have opened a lot of eyes.

Casting off its longstanding stereotype as the world's factory, China was suddenly creating what factories of the future will be producing. Breakthrough after breakthrough in industries such as artificial intelligence, electric cars, green technology and drug therapies made headlines around the world and attracted investment to China's shores.

The nation is expected to meet its 2025 growth target of 5 percent despite some slowdown in investment, a continuing slump in the property sector and softer consumer spending – areas targeted for improvement in the 15th Five-Year Plan (2026-30.) Exports have remained strong as China diversifies its focus away from its once-largest market, the US.

China's emergence on the world stage hasn't sat well with all countries, particularly the US, which fears loss of its dominance in global politics and trade. Trump and his "America First" mantra have led to the imposition of wide-ranging imports tariffs on all US trading partners – most notably China – and erected trade barriers on exports of materials the US considers vital to its national interest. The result has been a year of tensions in trade, disruption of long-established industry supply chains and geopolitical uncertainty. Despite all the headwinds, China hasn't blinked in its resolve to turn its creative prowess into a vision of the future.

China Biz Buzz reviews some of the major business trends this year and looks at how they will shape 2026.

Trade Tensions and Tariffs Wars

China-US trade relations dominated the world in 2025, starting in a dramatic escalation of hostilities before settling into an uneasy, temporary truce. The drama started when the Trump administration, crying foul in world trade balance and declaring "America First," slapped high tariffs on imports on all its trading partners and subjugated exports to what it considered its national interests. The protectionism peaked in the spring, with China, the world's second-largest economy, the target of the toughest US policies. At one point, Washington tariffs on Chinese imports soared to 145 percent and exports of chips and other advanced technologies were banned.

China wasn't cowed; it simply retaliated with its own tariffs on a vast array of US goods, including farm products like soybeans, and imposed restrictions on exports of raw materials the US needs, like rare earth minerals vital in industrial production. Bilateral trade volume plummeted, and global supply chains fractured under the strains.

A pivotal meeting in South Korea in late October between President Xi Jinping and President Donald Trump yielded a fragile, year-long trade truce. The US agreed to roll back some of its most punitive tariffs, while China committed to purchasing significant volumes of US farm products, including a multiyear promise for at least 25 million metric tons of soybeans a year, and relaxed export controls on rare-earth minerals and magnets.

The new year begins with the temporary truce setting the stage for a period of "managed rivalry," with the focus of competition expected to shift to technology. Both nations remain keen to lead the world in AI, data centers, advanced chip production, and biotech innovation. Non-tariff tools such as export controls and industrial subsidies are expected from both sides as they seek to improve their advantage and decouple dependence on one another.

What emerged this year is a common consensus that the US underestimated China's strength, vitality and resolve. Beijing showed it can't be bullied. Going forward, relations in 2026 will rely heavily on how Washington recalibrates its policies to the new reality

China's AI: From Breakthroughs to Deep Integration

The year 2025 marked a pivotal shift in China's AI landscape, moving decisively from foundational breakthroughs to deep, pragmatic integration of artificial intelligence across industry and daily life. Central to this transition was the significant leap in so-called large language models, where machines are fed vast amount of data to create a "digital brain" capable of duplicating many complex human functions. Flagship systems from Chinese companies like DeepSeek, Alibaba, Huawei and Baidu turned a page on the development of machine models and pushed the boundaries of their capabilities.

This technical progress directly fueled what China calls its "AI Plus" initiative, which seeks to transition artificial intelligence from the theoretical to the practical, with mass adoption across all sectors. AI is now a standard feature in smart manufacturing, consumer electronics and intelligent vehicles.

Continuing this thread, the 15th Five-Year Plan (2026-30) sets ambitious goals for AI. It seeks to boost the rate of AI agents and smart terminal use to 70 percent by 2027 and to 90 percent by 2030. Research firm International Data Corp has highlighted the dramatic increase in "machine thinking" and ease-of-use across game, mobile office, education, smart transportation and home appliance management sectors.

AI is also opening new horizons for discoveries in biopharmaceuticals and advanced industrial materials, and for the application of "embodied intelligence" to create humanoid robots. Robots from companies like AgiBot and Unitree may awe the public when they dance, run races and play football, but their emergence on the scene goes beyond entertainment, promising to transform how we learn, how we clean our homes, how we move goods, how we tend crops and how we care for the aged and disabled. Robots are even being designed to be emotional companions.

Amid China's rush to be a leader in world technology runs a deep desire to make the country more self-sufficient and less reliant on the vagaries of a shifting world order. But the government is keenly aware that the speed of AI development poses risks. It has set up systems to ward off "deep fakes" and scams easily generated by malevolent use of AI-generated content. It has stepped up protections for the security of personal data.

China is smoothing the path for AI pathfinders to obtain funds for research and development by setting up the STAR market in Shanghai to host promising startups with promising technologies. So-called "China Nvidias" Moore Threads and MetaX joined Cambricon in the market with dazzling share debuts, underscoring the national drive to fill a void created by US chip-export restrictions. In Hong Kong, Contemporary Ampere Technology (CATL), the world's largest maker of batteries for electric cars, was among the biggest IPOs in the world this year.

Looking ahead to 2026, the AI focus is expected to shift from sheer model capability to seamless, trustworthy and energy-efficient integration. Experts predict a surge in truly AI-native applications, major breakthroughs in embodied intelligence for tackling complex environments, and intensified global collaboration in trying to establish global ethical standards AI applications.

China's Biopharma Goes Global

China's biopharmaceutical industry has moved from a generic copycat to a developer of drug therapies in a year marked by stronger clinical results, a surge in cross-border licensing deals, faster approvals and a clearer divide between companies that commercialize innovation and those still stuck in volume-driven competition.

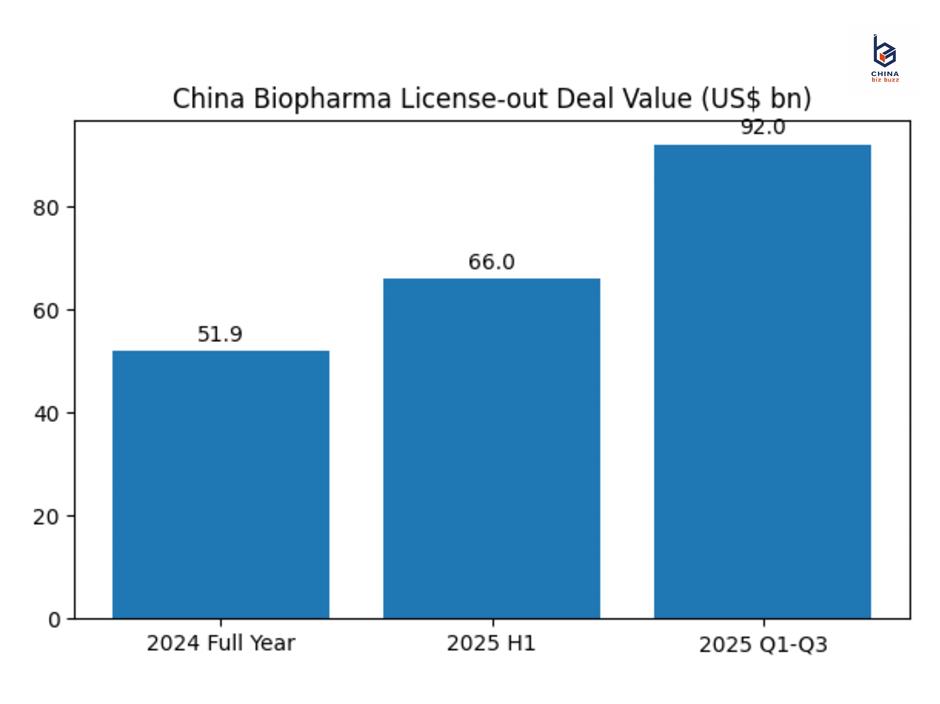

The biggest shift came from globalization. Overseas partnerships exceeding US$50 billion in the first eight months, with Pfizer's US$1.25 billion upfront agreement with 3SBio setting a record for a China-origin drug. Cross-border partnerships were concentrated in cancer treatment, immunology and metabolic diseases as the market pivoted to value from volume. Drug therapies to treat diabetes-2 and obesity created intense global competition.

The government has supported development of the domestic pharma industry by streamlining its process of regulatory approvals. As of December 1, China had cleared 66 Category-1 new drugs -- nearly five times the 2018 level – and increasingly aligned with global standards. Newly approved antivirals and immunology drugs demonstrated that domestic research and development can deliver products meeting urgent clinical needs.

Market performance, however, remained uneven. While overall sector revenue softened this year, creative drug developers and entities with solid long-term development prospects posted solid growth, supported by global clients and expanding product pipelines. Upstream biomanufacturing saw margin improvements. By contrast, medical devices and traditional biologics were weighed down by inventory cycles and intensified competition, though signs of stabilization emerged late in the year.

Looking ahead, China's biopharma is entering a period where success will be defined less by pipeline size and more by global competitiveness, regulatory clarity and marketing outcomes.

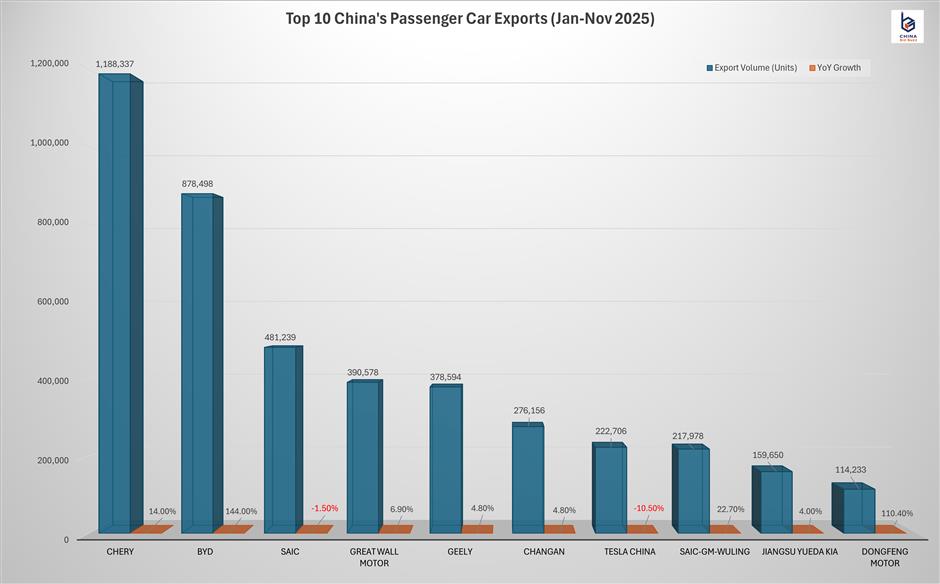

China Autos Make Inroads Overseas

The year 2025 marked a tipping point as Chinese mainland sales of new energy vehicles inched past those of internal combustion for the first time. Production and sales of electric and hybrid vehicles each surpassed the 10 million unit mark, solidifying the nation's dominance in the global market of green cars. The transition was exceptionally swift and earlier than industry expectations.

The year's dynamism was showcased at a record-breaking Shanghai Auto Show, which drew global attention and demonstrated the domestic industry's clout in competing with traditionally dominant foreign automakers. BYD retained its crown as the world's largest electric carmaker.

The industry boom also fueled a brutal, year-long price war that ate into some company profits and accelerated sector consolidation. Some carmakers, like Neta's HiPhi, fell by the wayside. The winners are those developing and applying advanced "smart driving" technologies.

Looking to 2026, new energy vehicles are forecast to sustain robust sales, amid estimates of 15 percent growth from 2025. However, that growth will be challenged by a downscaling of government subsidies on green vehicles, beginning January 1.

With the mainland market looking increasingly saturated and competitive, Chinese carmakers are looking abroad to keep sales figures rising strongly. Exports volume is forecast to increase as much as 40 percent, as China brands take their models to Southeast Asia, the Middle East, South America and Europe.

The future of both domestic and foreign sales is expected to rely heavily on application of artificial intelligence to motoring, with increasing deployment of advanced autonomous features, like Navigate on Autopilot, and the integration of sophisticated AI in cockpits. Carmakers are also preparing themselves for more relaxed government regulation on self-driving cars, with robotaxi firms leading the way both at home and overseas.

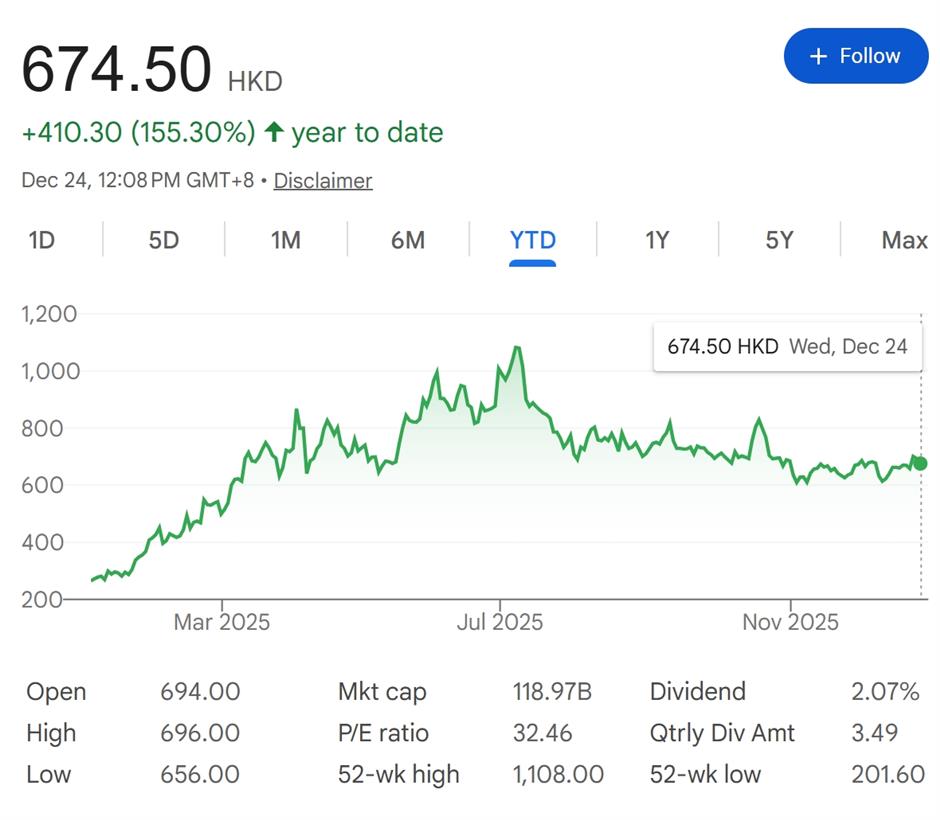

Hong Kong: the World's Biggest IPO Market

In 2025, Hong Kong raised about HK$280 billion (US$37 billion) in some 100 initial public offerings, giving the city the crown as the world's biggest IPO market. That volume exceeds the US$20.5 billion raised by companies listing in New York and accounts for nearly a third of all IPOs globally.

Mainland companies going public produced some stellar performances. The HK$41 billion IPO by battery maker Contemporary Ampere Technology (CATL), the HK$25 billion share sale of miner Zijin Gold International and construction machinery maker Sany Heavy Industry's HK$12.4 billion fundraising all ranked among the world's top 10 this year.

Mainland companies accounted for 88 percent of Hong Kong IPOs this year, tapping into international capital by leveraging Hong Kong's role as a financial hub and bridge between Chinese mainland and global markets. The Hong Kong exchange has facilitated their fundraising by streamlining the listing process.

Looking ahead, Hong Kong's IPO market is forecast to remain robust, with more than 300 active filings, including nearly 100 from mainland companies, in the pipeline.

"The momentum will continue, as Chinese mainland and Hong Kong markets grow into a highly complementary stage for development," said Lawrence Lau, leader of financial accounting advisory services at Ernst & Young China. "Hong Kong's reforms in listing, trading and cash flows will allow more flexibility, adding attractiveness for the market as a global financial hub."

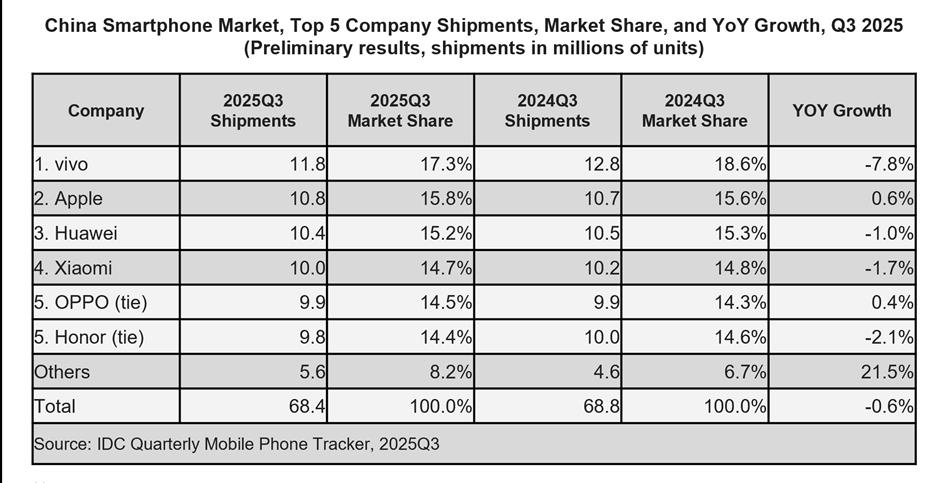

Fierce Competition, Tech Shifts for Smartphones

The Chinese smartphone market in 2025 was characterized by intense domestic competition and a significant push towards premium, advanced models, despite some softness in consumer demand and economic headwinds.

The Chinese government's national program of consumer subsidies on purchases of new goods to replace older ones underpinned sales for domestic brands like Huawei, Oppo, Vivo and Xiaomi, whose models were mostly priced within the 6,000 yuan (US$845) cap of the program.

In the second half, the launch of major new flagship models intensified the competition. Apple's iPhone 17 series, released in September, outperformed expectations, particularly its base model with expanded storage. But its iPhone Air models featuring e-sim service received a more lukewarm market response. At the same time, Chinese phone giants introduced groundbreaking technologies, including Huawei's foldable models, the Vivo X300 with enhanced camera functions and bigger battery capacity in all domestic brands, compared with iPhones.

In the third quarter, the top five brands in China were Vivo, with a 17.3 percent market share; Apple, with 15.8 percent; Huawei, with 15.2 percent; and Xiaomi with 14.7 percent. Oppo and Honor tied for fifth, according to research firm International Data Corp.

The biggest trend of the year was the application of artificial intelligence in mobile devices. ByteDance's Doubao model, an AI-powered smartphone, unexpectedly has become a market sensation in China, demonstrating a strong consumer appetite for new technology while simultaneously raising discussions around privacy and security.

Retail Embraces Change Amid Mixed Performance

China's retail and fashion sector in 2025 ends the year with mixed results. Money flowed toward brands and formats that demonstrated pricing power, operational efficiency and clear consumer value, while discretionary, lower-margin segments continued to lag.

One of the year's standouts was Laopu Gold, which delivered strong revenue, profit and network expansion as consumers shifted toward jewelry with heritage symbolism. However, historically high gold prices may limit future demand. E-commerce giant JD.com's brand value rose 5.4 percent to US$18.8 billion, ranking eighth globally, while Pinduoduo entered the global top 20 for the first time. Pop Mart, creator of the Labubu doll shopping frenzy, retained its leadership in the collectibles category, with the market expected to hit up to 877 billion yuan (US$125 billion).

Retail rooted in consumer experience was a winner. Vuitton's new downtown Shanghai flagship store, shaped like the prow of a ship, extended average customers' stays to more than two hours with its stunning displays and curated merchandising.

Online retail deepened its footprint. "Instant delivery" services promising food and other goods on the doorstep within an hour of ordering fueled a massive competition between Meituan, JD and Alibaba, with deep discounting and marketing costs eating into profits. Still, instant retail and livestream commerce maintained double-digit growth through October as e-tailers accelerated automation with high-tech navigation systems, service robots and other tools.

China's nationwide trade-in subsidies program unlocked more than 2.4 trillion yuan in consumer replacement spending. The program covered a wide array of products, including electronics, home appliances and electric vehicles.

Looking ahead, investors in 2026 are likely to favor companies adept at combining brand clarity, efficient marketing and multichannel sales over those that simply rely on traffic volume.

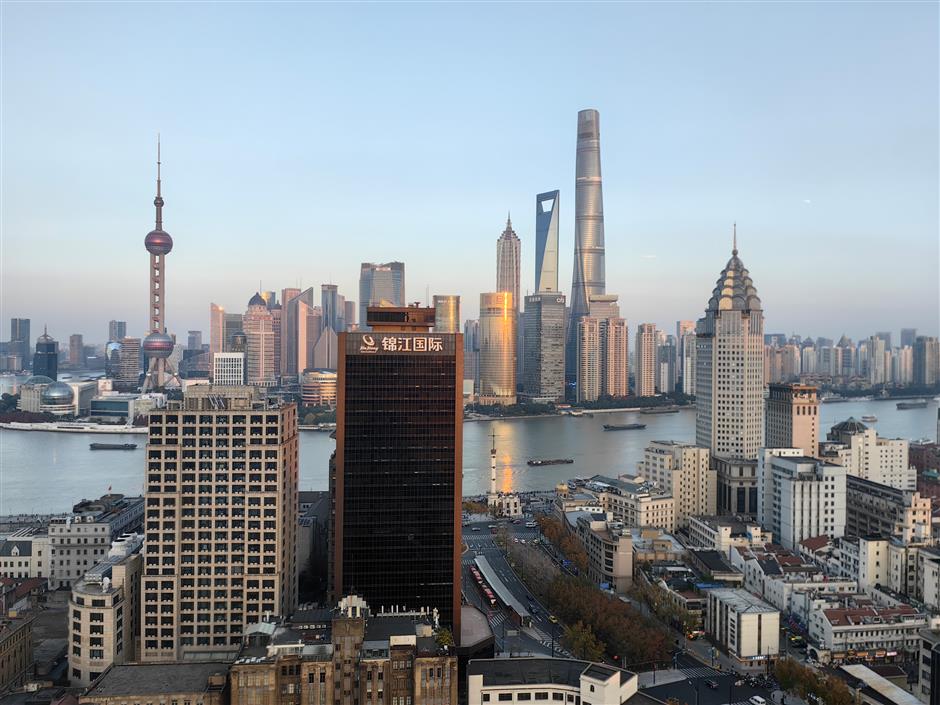

Shanghai Finance Market: the Economic 'Bloodline'

Shanghai accelerated the pace of transforming itself into a global financial center after the State Council, China's cabinet, released a document in June to guide Shanghai's financial sector's development in the next five to 10 years. The document envisions leap-frogging progress in capital market adaptability, competitiveness and inclusiveness, underpinned by government commitments to open its financial sector wider to foreign investors and companies.

Shanghai's financial industry is often dubbed the "bloodline" of economic development. It rose to the sobriquet this year, surpassing London to rank second globally behind only New York in terms of strength in combining finance and technology, according to an index compiled by the Shanghai Fintech Industry Alliance.

Regulators have strengthened Shanghai's STAR market as a fundraising host to promising technology companies, even if they have yet to show a profit. The dazzling 400 percent share surge in chipmaker Moore Threads's 8 billion yuan (US$1.1 billion) initial public offering on December 4 was surpassed only two weeks later when integrated-circuited maker MetaX shares surged nearly 700 percent in the debut of its 4.2 billion yuan IPO.

The benchmark Shanghai Composite Index climbed over the psychologically important level of 4,000 points twice this year, a record in one decade, and industry analysts like Standard Chartered bank and Goldman Saches are predicting more of the same in 2026.

Shanghai's financial market has undergone profound changes in terms of function, structure and investment orientation, accompanied by increased funds flow into technology, said Tu Guangshao, chairman of the Executive Council at the Shanghai Finance Institute. "Such changes will accelerate in the next five years."

In Case You Missed It...

![[Quick News] Canada & UK Visa Free Travel Dates Announced](https://obj.shine.cn/files/2026/02/15/59d52494-f6ae-42da-8f15-ce17c49bc541_0.jpeg)