Chinese Stock Markets Stung as Rallies in Gold, Silver End With a Bang

China's stock markets retreated on Friday amid Asian wobbles in the prices of gold and silver that turned into a rout in later New York trading. But for January as a whole, mainland markets managed a strong performance.

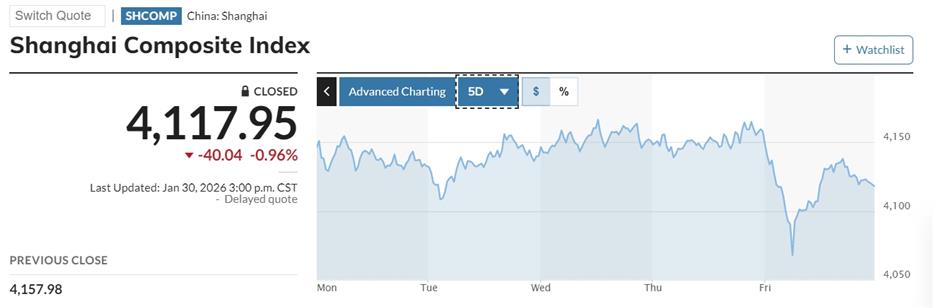

The benchmark Shanghai Composite Index lost 0.96 percent on Friday to end at 4,117.95 points, wrapping up the week down 0.44 percent. For the month, it was up 3.76 percent.

The Shenzhen Composite Index dropped 1.62 percent for the past five trading days but gained 5 percent in January.

On the Shanghai Gold Exchange on Friday, the spot price of gold lost more than 5 percent, and silver plunged 15 percent. Declines continued into New York trading, where gold fell as much as 9 percent, its biggest slide in four years. Silver, which soared 135 percent in 2025, dived as much as 31 percent, its worst trading day since 1980.

"The unexpected plunge of gold prices disrupted stock market performances around the world, including China's," said Chen Hongbin, chief economist at Springs Funds. "But the price adjustments in gold and other precious metals were expected after such strong rises for quite some time."

Shares of Shanghai-listed Zijin Mining, China's largest gold miner, lost 7.6 percent on Friday, while others, including Shandong Gold, ZhongJin Gold and Chifeng Gold, all declined by the daily limit of 10 percent.

However, the tech sector continued to show strength as euphoria about AI technology development continued. The tech-focused ChiNext index gained 1.3 percent on Friday, logging a 4.5 increase for January. Shares in leading domestic chipmaker Cambricon rose 0.6 percent in Shanghai.

"China has put enormous emphasis on tech growth in its economic plan for the next five years," Chen said. "Tech companies have been in the spotlight since the start of this year, with their shares continuing to be favored by investors."

Outside the Chinese mainland, Hong Kong's Hang Seng Index rose nearly 4 percent in January despite a 2 percent setback on Friday. In a vote of confidence in China's consumer sector, shares in Busy Ming, a big Chinese retailer of snacks and beverages, surged 69 percent from their offer price in their trading debut in Hong Kong on Wednesday after an initial public offering that raised HK$3.67 billion (US$470 million).

Japan's Nikkei index advanced nearly 5.93 percent in January, and South Korea was the best-performing market in Asia, with the Kospi index surging 21 percent, aided by strong earnings from top chipmakers Samsung Electronics and SK Hynix.

In New York, the broad benchmark S&P 500 index fell 0.4 percent on Friday, as volatility in precious metals outweighed a generally favorable reaction to the appointment of former Federal Reserve governor Kevin Warsh to chair the central bank when incumbent Jerome Powell's term ends in May. The Nasdaq dropped almost 1 percent. Still, the major markets managed gains for January, with the S&P up 1.4 percent and the Nasdaq advancing 1 percent. In Europe, the Stoxx600 index rose 0.6 percent on some strong corporate earnings.

In Case You Missed It...

![[See & Be Seen] We Went to RedNote's Anime Comics & Games Fair](https://obj.shine.cn/files/2026/01/30/8be5868a-d04d-47d4-b4be-7e7effe000d1_0.jpg)

![[Street Chic] 7 Cuties in Shanghai for January](https://obj.shine.cn/files/2026/01/29/1739ef51-86d9-4e6d-a40e-90614a63037b_0.png)