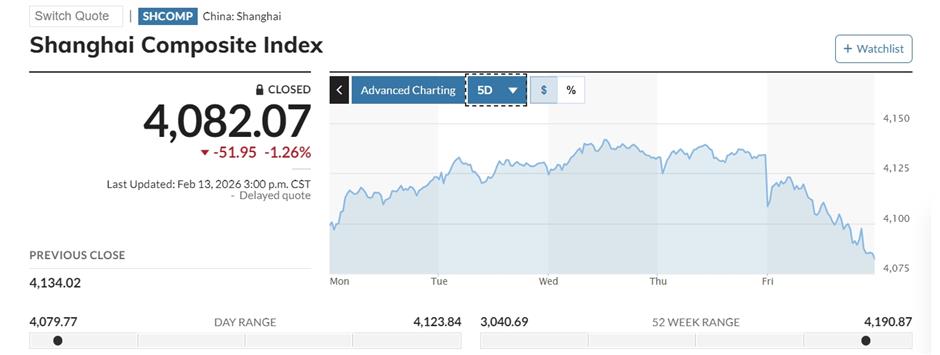

Year of the Snake Slithers to End on Lower Close in Stock Prices

China's stock markets slumped on the last trading day of the Year of the Snake as investors secured their portfolios against possible shocks that may occur during the nine-day Chinese New Year holiday break.

Amid a general global market downturn led by technology stocks, the benchmark Shanghai Composite Index lost 1.26 percent on Friday, while the Shenzhen Component Index fell 1.28 percent and tech-heavy ChiNext dived 1.57 percent. More than 3,800 A-share stocks closed lower, with 52 billion yuan (US$7.5 billion) in funds leaving the market.

Hong Kong's Hang Seng Index fell 1.7 percent on Friday, with the technology index losing about 1 percent following 1.65 percent loss on Thursday.

"The drop is expected as individual investors usually choose to sell shares before a long holiday to keep money flexible for use, while institutional investors also sell to reduce uncertainties," said Xu Gao, an economist at BOC International (China) "But this slump is a bit beyond expectations – the result of a selling spree fueled by uncertainties related to tech shares."

Tech shares, particularly those related to AI technology development, have been volatile since the start of the year amid recurring concerns about the US$700 billion in AI capital spending pledged for this year by the biggest US tech companies. On Monday, China's Class A-shares jumped nearly 3 percent after a strong rally in New York that subsequently faded during the week. Wall Street investors have rolled their concerns about the effects of AI into other sectors, including software, legal services, property and logistics.

There were bright market spots. Shares in Shanghai-based AI developer MiniMax rose 8.8 percent on Friday after a surge of 15 percent on Thursday, when the company launched its M2.5 open-source model on its overseas website. Similarly, Zhipu AI jumped over 20 percent in Hong Kong trading on Friday after the Beijing-based company released its GLM-5 open-source large-language model with enhanced coding capabilities.

In an encouraging sign for Chinese mainland markets, South Korean investors have ramped up purchases of Chinese stocks since the start of the year, with US$20.7 million in net purchases that appeared to favor AI shares, according to the Korea Securities Depository. MiniMax topped January purchases. Other popular investments were Montage Technology and the ChinaAMC CSI 300 Index exchange-traded fund.

"Performances of tech shares are hard to predict but solid information of tech achievements can help to keep them stay high," Xu said.

On the downside, shares in Chinese food delivery giant Meituan tumbled 3.2 percent in Hong Kong on Friday after its preliminary earnings guidance warned of a loss of up to 24.3 billion yuan (US$3.5 billion) for 2025 due to "intense industry competition," with Alibaba and JD.com in the fast food-delivery market. The company said losses are likely continue in the first quarter of this year.

Shares in tech giants Alibaba, JD, Tencent, Meituan, Baidu and NetEase all fell on Thursday after Chinese regulators summoned 12 major online platforms in for talks over irregularities in online train tickets sales ahead of next week's Chinese Lunar New Year. The summons was triggered by public complaints over add-on charges and booking practices.

During the Year of the Snake that ends on February 16, tech shares enjoyed a heyday. The ChiNext gained 58 percent, outperforming the Shanghai Composite Index, which rose 25 percent, and the Shenzhen Component Index, which increased 38 percent.

The first trading day in the Year of the Horse will be on February 24.

Apart from China, Japan's Nikkei lost 1.2 percent on Friday, while South Korea's Kospi slid 0.28 percent.

On Wall Street, major markets closed mostly flat on Friday after a day-earlier rout. The tech-heavy Nasdaq fell 0.2 percent, capping a loss of 2.1 percent for the week. The broader S&P 500 slide 1.4 percent in five trading days. The Stoxx600 index in Europe closed down 0.13 percent on Friday after a week of losses.

In Case You Missed It...